This page is for FTR Clients Only.

To share this information please utilize our public landing page, www.FTRintel.com/Coronavirus.

This page will be updated regularly with the latest intelligence that we are able to provide. As information becomes outdated, we will archive items so that this page remains relevant. In addition to the information on this page, FTR provides a comprehensive suite of products and services for transportation professionals. Click here to view samples and more information for the additional reports available to you.

Interactive Dashboards:

FTR has developed a series of interactive dashboards to help transportation professionals understand the real-time true impacts of the COVID-19 pandemic on the rates and volumes in the freight marketplace. The map below assesses the state-level impacts on the U.S. trucking industry by four equipment types – dry van, refrigerated, flatbed, and specialized – using Truckstop.com spot market data.

Page Contents:

Interactive Dashboards

COVID-19 Freight Recovery Indexes

Commentary and Updates

Trucking Market Update Podcast

Preparing for 2021 [Webinar Replay]

FTR’s analysis examines historical seasonal behavior regarding rates in each state and normalizes the data to represent how the trucking environment would look in a typical growth economy. By comparing that norm to the current rate environment, we can understand how COVID-19 is affecting rates on a state-by-state basis.

To help you better understand how the map works, visit our Knowledge Base FAQ.

COVID-19 Freight Recovery Index:

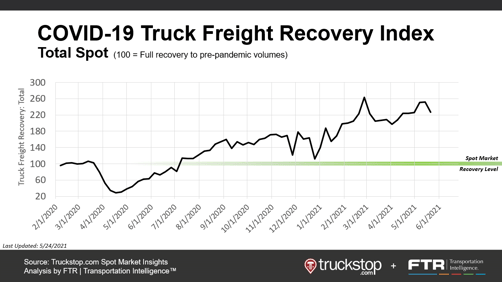

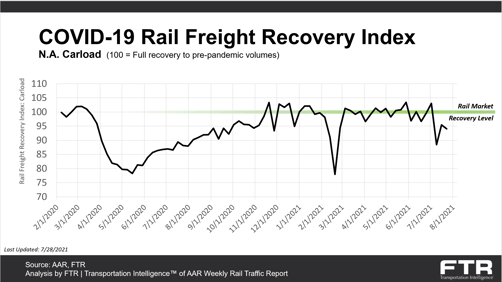

The COVID-19 Freight Recovery Index for Rail and Trucking measure the industry's response and recovery based on pre-pandemic levels, while accounting for historical patterns and seasonal fluctuations. Indexes are now available for trucking as a total, as well as narrowed by dry van, refrigerated, and flatbed, using Truckstop.com spot rate metrics and for rail showing North American carload and intermodal, economically sensitive freight, automotive, and energy sectors. Download both indexes below to view all graphs available.

|

May 24 |

Truck Freight Recovery Index |

Freight activity settles after working through International Roadcheck disruption.

Total: Seasonally adjusted freight activity fell nearly 10% after a couple of weeks of elevated volume due to the International Roadcheck inspection event. Volume is about 14% below the February peak but about 122% above the pre-pandemic baseline.

Dry Van: The Dry Van segment dropped nearly 17% to a level that is about 4% higher than volume during the week before Roadcheck. The index is about 39% below February’s weather-induced peak but about 140% above the pre-pandemic base.

Refrigerated: Temperature-controlled activity fell about 14% to a level that is about 4% below volume during the week before Roadcheck. Volume was nearly 29% below the February peak but about 126% higher than the pre-pandemic base.

Flatbed: The Flatbed segment declined nearly 6% after setting five straight post-pandemic highs. Volume was about 1% higher than that during the week prior to Roadcheck and was about 119% higher than the pre-pandemic base.

Click here to download the PDF for our complete analysis. >

|

May 20 |

Rail Freight Recovery Index |

Carload and intermodal volumes each declined in the latest week as there was a pause in the gains that have marked the last few weeks.

N.A. Carload: The carload market fully made up its decline from the prior week with significant gains from the energy sector.

N.A. Intermodal: Intermodal volumes recovered in the latest week, but not as fully as their carload counterparts. Trailer volumes are starting to weigh on overall intermodal results.

Economically Sensitive Freight: Economically sensitive freight did not recover as quickly as the carload market as its commodities held closer to flat in the latest week, increasing only slightly.

Automotive: Automotive volumes increased a little in the latest week, but it does not appear that the supply disruptions that have held back production levels are over yet.

Energy: Energy hit its highest level since the pandemic began in the latest week as coal and petroleum products each increased in the latest week.

Commentary, Reports, and Updates:

This section will continue to host the most relevant intelligence that FTR is able to provide on how the COVID-19 pandemic is affecting the transportation markets. Check back frequently as we add new information.

|

Updated Weekly |

Podcast | Trucking Market Update & Rail Market Update |

| This content is relevant for: Rail, Shipping, Equipment, and Freight Focused Professionals |

Rail Market Update on the State of Freight Podcast

|

May 24 |

Spot Market Insights |

| This content is relevant for: Rail, Trucking, Shipping, Equipment, and Freight Focused Professionals |

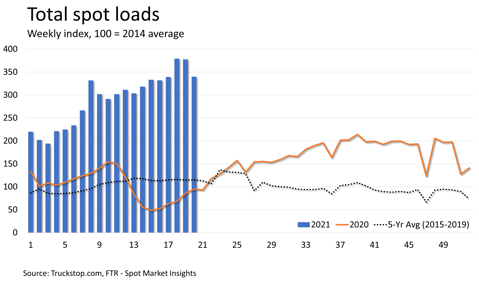

Spot volume settles from Roadcheck while rates set a record

After two weeks of inflated volume due mostly to International Roadcheck, load postings fell to essentially the level recorded during the week before the inspection event. Spot volume in the Truckstop.com system dropped 10% during the week ended May 21 (week 20). Load postings were down in all segments. Total spot rates excluding fuel surcharges rose nearly 3 cents for the second record in three weeks. Truck postings rose, and the ratio of loads to trucks fell to its lowest level in four weeks.

Click here to view this complete analysis. >

|

January 2021 |

State of Freight Replay — Preparing for 2021

|

| This content is relevant for: Rail, Trucking, Shipping, Equipment, and Freight Focused Professionals |

Presenters: Eric Starks, Avery Vise, Clay Slaughter

Presenters: Eric Starks, Avery Vise, Clay Slaughter

Moderator: Jonathan Starks

The January 2021 State of Freight™ Webinar looked at the key uncertainties that could change the 2021 outlook for shippers and carriers. With consumer demand holding at strong levels and the industrial sector starting to gain traction, the freight markets have entered 2021 with a solid footing. View the replay below for the risks you should consider when planning your path forward.

Click here to view the replay and graphs for this webinar. >

ARCHIVED CONTENT |

As the situations evolve, FTR is archiving content that is no longer current.

Eric Starks

Chairman & CEO

FTR's priority during these uncertain times is to leverage our expert analysis and the Freight•cast™ model to help our clients understand how the coronavirus crisis will affect their businesses. Visit this page often as we provide updates and resources for navigating these trying times. While we are providing much of this information to the public, we continue to provide greater and more detailed information in the standard products and services that are available only to FTR clients. Contact us to learn how you can get the transportation intelligence you need.