STATE OF FREIGHT TODAY

Your source for complimentary industry content from FTR

Whether you prefer to read updates, listen to podcasts, or take in the most recent webinar, this page is the source for complimentary FTR content covering everything associated with the commercial freight industry.

When you're ready to learn how FTR can help take you to the next level, download a sample report at the bottom of the page!

Sign up for weekly updates!

Truckstop & FTR Spot Pressure Heat Map

Load Volumes & Spot Rates

Learn more about the TruckStop & FTR U.S. Spot Pressure Heatmap at this knowledgebase article:

https://help.ftrintel.com/knowledge/faq-spot-pressure-heatmaps

Spot Market Insights

April 22, 2024

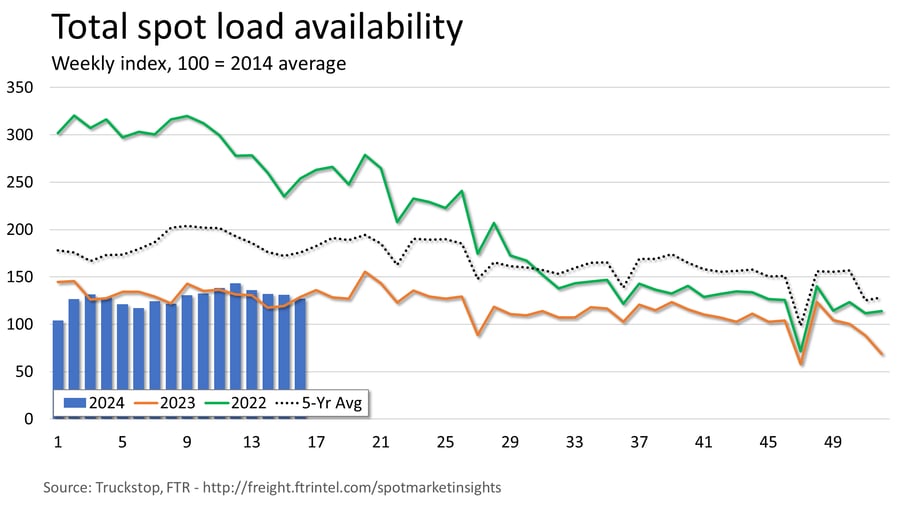

Total spot rate barely moves in the latest week

The total broker-posted rate in the Truckstop system ticked up a fraction of a cent during the week ended April 19 (week 16) as an increase in flatbed rates roughly offset declines in dry van and refrigerated rates. The total market rate was at its highest level since the end of June, but rates for van equipment were at their lowest levels in about a year. Flatbed rates were at their highest level since January of last year. Even so, van rates were slightly higher y/y while flatbed rates were down.

Trucking & Rail Updates from FTR

Updated weekly with downloadable slide decks

Updated weekly on Tuesday, FTR's Avery Vise provides timely updates on key trucking topics moving the market.

.png?width=1755&height=1755&name=Key%20Issues%20in%20Transportation%20Webpage%20Graphics%20(1).png)

Register today for our Complimentary Webinar - State of Freight: Key Issues in Transportation.

Updated bi-weekly on Friday, FTR's Jonathan Starks provides timely updates on rail topics moving the market.

Most Recent Orders & Indices

Class 8 Orders

New class 8 truck orders are normally a leading indicator of the state of the economy. Follow our preliminary order updates to understand the direction of the economy and commercial vehicle production.

Trailer Orders

Strong freight demand dictates the need for new trailers. Follow our preliminary trailer orders to monitor the underlying health of freight and track the demand for new equipment.

Trucking Conditions Index

This exclusive FTR metric combines millions of data points known to influence truck fleet behavior to provide one index measuring the industry's health.

Shippers Conditions Index

This exclusive FTR metric combines millions of transportation data points into one index to help shippers understand rate pressure across the industry.

Weekly Transportation Update

Weekly Transportation Update: Automotive production was quite strong in March

Weekly Transportation Update: Consumer inflation rose in March at the same rate as February

.png)