Spot volume settles from Roadcheck while rates set a record

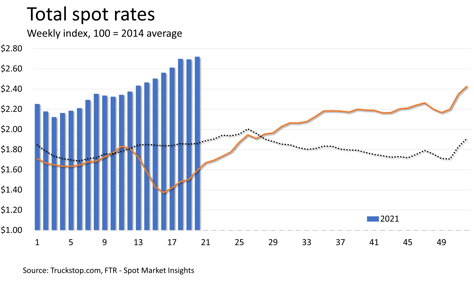

After two weeks of inflated volume due mostly to International Roadcheck, load postings fell to essentially the level recorded during the week before the inspection event. Spot volume in the Truckstop.com system dropped 10% during the week ended May 21 (week 20). Load postings were down in all segments. Total spot rates excluding fuel surcharges rose nearly 3 cents for the second record in three weeks. Truck postings rose, and the ratio of loads to trucks fell to its lowest level in four weeks.

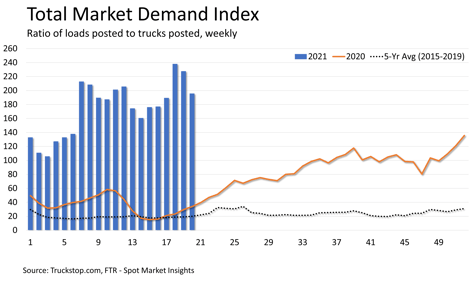

Load volume in week 20 was about 259% above the same 2020 week and 195% above the five-year average (2015-2019). Truck postings rose 4.7%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – eased to its lowest level since week 17.

Load volume in week 20 was about 259% above the same 2020 week and 195% above the five-year average (2015-2019). Truck postings rose 4.7%, and the Market Demand Index – the ratio of loads to trucks in the Truckstop.com system – eased to its lowest level since week 17.

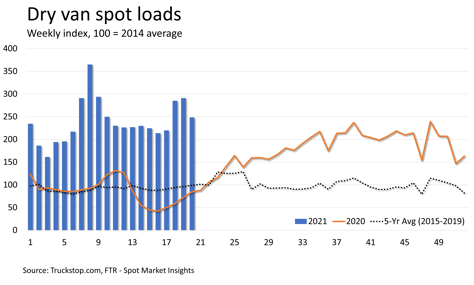

Dry van load postings fell 14.5%, which is the sharpest decline in 11 weeks. Although total spot volume basically fell back to pre-Roadcheck levels, dry van load postings in week 20 were about 13% higher than during the week before the event. Load postings were nearly three times the level in the same 2020 week and about two and a half times the five-year average. Dry van truck postings fell 3.3%, but the larger decline in load postings resulted in a weaker dry van MDI.

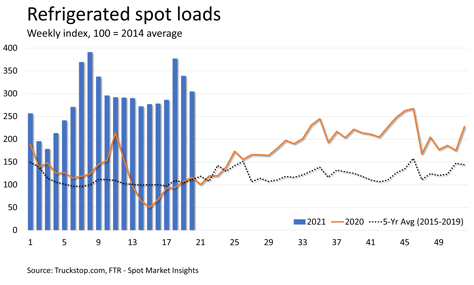

Refrigerated load postings fell about 10% for the second straight week. As with dry van, refrigerated volume was higher than in the week before International Roadcheck. In the case of refrigerated, volume was more than 6% higher in week 20 than in week 17. Refrigerated load postings were about 164% higher than the same 2020 week and about 174% above the five-year average. Refrigerated truck postings were up 3.7%, resulting in the lowest refrigerated MDI in four weeks.

Refrigerated load postings fell about 10% for the second straight week. As with dry van, refrigerated volume was higher than in the week before International Roadcheck. In the case of refrigerated, volume was more than 6% higher in week 20 than in week 17. Refrigerated load postings were about 164% higher than the same 2020 week and about 174% above the five-year average. Refrigerated truck postings were up 3.7%, resulting in the lowest refrigerated MDI in four weeks.

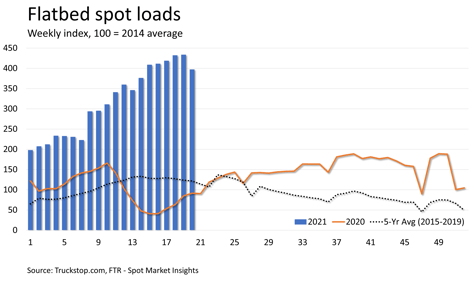

Flatbed load postings fell 8.4% for the first drop in volume in eight weeks and the largest this year. Volume was about 334% higher than the same week last year and about 227% above the five-year average. Truck postings increased 4.9%, and the flatbed MDI eased to the lowest level in five weeks.

Flatbed load postings fell 8.4% for the first drop in volume in eight weeks and the largest this year. Volume was about 334% higher than the same week last year and about 227% above the five-year average. Truck postings increased 4.9%, and the flatbed MDI eased to the lowest level in five weeks.

Despite the easing of load volume, total rates increased to a record, surpassing the record set in week 18. The broker-posted rate per mile excluding fuel surcharges rose by nearly 3 cents. Total spot rates were about 71% higher than the same 2020 week. Dry van rates barely moved – easing just four-tenths of a cent – and were about 68% above the same week last year. Refrigerated rates were up about 2 cents and were about 49% higher than the same 2020 week. Flatbed rates increased 3 cents to a record level and were about 81% higher than the same week last year.

Despite the easing of load volume, total rates increased to a record, surpassing the record set in week 18. The broker-posted rate per mile excluding fuel surcharges rose by nearly 3 cents. Total spot rates were about 71% higher than the same 2020 week. Dry van rates barely moved – easing just four-tenths of a cent – and were about 68% above the same week last year. Refrigerated rates were up about 2 cents and were about 49% higher than the same 2020 week. Flatbed rates increased 3 cents to a record level and were about 81% higher than the same week last year.