September 2, 2025

Van spot rates rise sharply heading into the holiday

Broker-posted spot rates in the Truckstop.com system for dry van and refrigerated van equipment logged big gains during the week ended August 29 (week 34), although the increases largely were in line with seasonal expectations. Dry van spot rates were the highest in seven weeks while refrigerated spot rates were the highest since the beginning of the year except for the mid-year peak. Although van rates were up very strongly versus the same 2024 week, those comparisons are skewed somewhat by calendar distortions.

Total load activity increased 1.2%, essentially the same as the decrease in the previous week. Total volume was 29% higher than it was during same 2024 week, but a disconnect between the timing of 2024 and 2025 weeks related to the Labor Day holiday means that a more meaningful comparison would be almost 22% higher. Total truck postings declined 2.2%, and the Market Demand Index – the ratio of load postings to truck postings in the system – increased to its highest level in seven weeks.

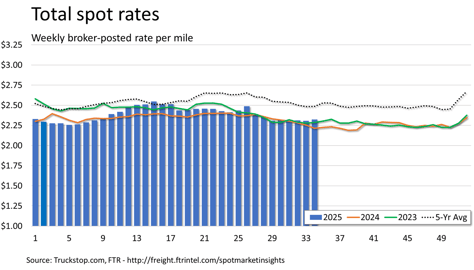

The total market broker-posted spot rate increased nearly 2 cents for only the second increase in eight weeks due mostly to seasonal weakness in flatbed. Total rates were about 5% higher than the same 2024 week or a little more than 4% when adjusted for the calendar distortion. Van spot rates would be expected to soften sequentially over the remainder of September before firming in advance of the fall holidays.

Dry van spot rates increased about 7 cents. Rates were 5.7% higher than the same 2024 week or about 2% when adjusted for the calendar distortion. Dry van loads increased 5.9%. Volume was nearly 19% higher than in the same week last year – 10% higher when adjusted for the calendar distortion.

Refrigerated spot rates jumped just over 15 cents. Rates were more than 10% higher than during the same 2024 week but less than 5% higher when adjusted to better align the time frames in 2024 and 2025. Refrigerated loads rose 8.5%. Load volume was more than 2% below the same week last year but about 7% lower when adjusted for comparable time periods in both years.

Flatbed spot rates declined 1.4 cents for the eighth straight week of decreases – typical for this time of the year. Flatbed rates did not see the same scope of distortion versus 2024 levels that van rates did. Rates were nearly 4% above the same 2024 week and 5% below the five-year average. Flatbed loads decreased 2.8%. Load volume was nearly 48% above the same 2024 week and nearly 39% higher when adjusted for the calendar distortion.