August 25, 2025

Van spot rates mixed as flatbed’s gradual slide continues

For the second time in three weeks, broker-posted spot rates in the Truckstop.com system for dry van and refrigerated equipment moved in oppositive directions during the week ended August 22 (week 33). Dry van spot rates declined to their lowest level in 15 weeks. Refrigerated spot rates rose for a fourth straight week to their highest level in seven weeks. Flatbed spot rates declined for a seventh straight week, although the cumulative decrease in the past four weeks is barely more than a penny.

Total load activity eased 1.3% after rising 5.5% in the previous week. Total volume was close to 27% higher than it was during same 2024 week but about 18% below the five-year average. As has been the case for most of the year, flatbed is mostly responsible for year-over-year volume strength, although dry van loads also were strong versus the same 2024 week. Total truck postings ticked up 0.8%, and the Market Demand Index – the ratio of load postings to truck postings in the system – declined slightly to its lowest level in four weeks.

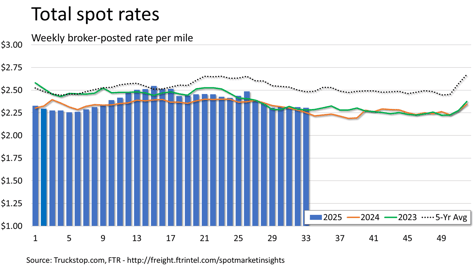

The total market broker-posted spot rate declined seven-tenths of a cent after holding flat during the previous week. Total rates were 2.3% higher than during the same 2024 week – the strongest comparison in seven weeks – but were a bit more than 7% below the five-year average. Over the past four weeks, the total market rate has risen or fallen by less than 1 cent each week, and rates in the latest week were essentially the same as they were in week 29. Spot rates for dry van and refrigerated equipment typically rise during the current week (week 34) and next week due to Labor Day.

Dry van spot rates decreased more than 3 cents after rising just over 2 cents in the prior week. Although dry van rates were the lowest since the week before International Roadcheck, they were only marginally lower than they were in week 24. Rates were nearly even with the same week last year at up just 0.1%, but they were 12.5% below the five-year average. Dry van loads eased 1.1%. Volume was about 11% higher than in the same week last year but about 33% below the five-year average.

Refrigerated spot rates increased just over 3 cents after rising 3.7 cents in the previous week. Rates were about 4% higher than during the same 2024 week – the third strongest comparison this year – but 7.6% below the five-year average for the week. Refrigerated loads ticked up 0.4%. Load volume was more than 8% below the same week last year and more than 39% below the five-year average.

Flatbed spot rates declined half a cent – the largest decrease in four weeks. The seven-week downward trend is very much in keeping with seasonal expectations for flatbed spot rates in July and August. Rates were 2.4% above the same 2024 week – the strongest comparison in seven weeks – but 6.4% below the five-year average. Flatbed loads decreased 2.4%. Load volume was about 50% above the same 2024 week but 7.4% below the five-year average.