August 18, 2025

Van spot rates rise by the most since mid-year

Broker-posted spot rates in the Truckstop.com system for both dry van and refrigerated equipment posted their strongest increases in six weeks during the week ended August 15 (week 32). Refrigerated spot rates rose for a third straight week for the first time this year. Dry van spot rates recovered more than the prior week’s decrease. Flatbed spot rates barely moved but technically declined for a sixth straight week for the first time since last August. Spot rates largely moved seasonally.

Total load activity increased 5.5% after falling more than 10% in the previous week. Total volume was more than 25% higher than it was during same 2024 week but about 14% below the five-year average. In a highly unusual situation, total truck postings essentially matched the increase in loads, and the Market Demand Index – the ratio of load postings to truck postings in the system – barely changed.

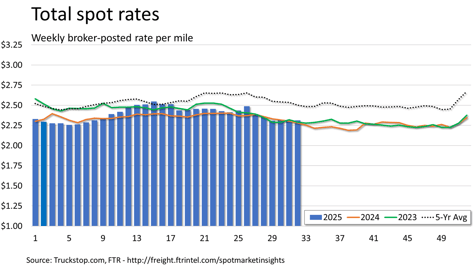

The total market broker-posted spot rate was unchanged after barely budging during the previous week. Total rates were 1.4% higher than during the same 2024 week but were 7.5 % below the five-year average.

Dry van spot rates increased about 2 cents after declining by more than 1 cent in the prior week. Rates were 0.5% higher than in the same 2024 week but nearly 12% below the five-year average. Dry van loads increased 3.2%. Volume was 10.5% higher than in the same week last year but nearly 31% below the five-year average.

Refrigerated spot rates increased 3.7 cents after rising by about 2 cents in each of the previous two weeks. Rates were more than 2% higher than during the same 2024 week but about 8% below the five-year average for the week. Refrigerated loads increased 4.4%. Load volume was about 10% below the same week last year and more than 37% below the five-year average.

Flatbed spot rates dipped a tenth of a cent. Although rates technically have been down for six consecutive weeks, the cumulative decrease in the past three weeks has been just over half a cent. Rates were nearly 1% above the same 2024 week but 7.5% below the five-year average. Flatbed loads rose 5.4%. Load volume was about 50% above the same 2024 week but about 1% below the five-year average.