August 4, 2025

Van spot rates end post-holiday slide

Broker-posted spot rates in the Truckstop.com system for dry van and refrigerated equipment increased for the first time in four weeks during the week ended August 1 (week 30), although the gains in both cases were small. Flatbed spot rates declined for the fourth straight week, but the decrease in the latest week was marginal. The moves for all three equipment types were in line with seasonal expectations for the beginning of August as van rates tend to stabilize while flatbed rates continue to fade.

Total load activity increased 5.9%. Total volume was about 14% higher than it was during the same 2024 week but almost 16% below the five-year average. Total truck postings fell 5.2%, and the Market Demand Index – the ratio of load postings to truck postings in the system – rose to its highest level in three weeks.

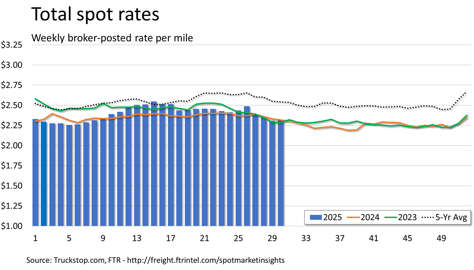

The total market broker-posted spot rate ticked up by about 1 cent after falling more than 4 cents in the prior week. Total rates were nearly flat year over year (y/y) at down 0.2% but were about 9% below the five-year average.

Dry van spot rates increased 1.7 cents after falling around 4 cents during the previous week. Rates were flat versus the same 2024 week but 12% below the five-year average. Dry van loads increased 7.3%. Volume was about 7% below the same week last year and 27% below the five-year average.

Refrigerated spot rates increased 2.1 cents after rising falling 2.6 cents in the prior week. Rates were about 2% higher than during same 2024 week for the first positive comparison in four weeks. Rates were more than 8% below the five-year average for the week. Refrigerated loads increased 4.9%. Load volume was more than 6% below the same week last year and more than 35% below the five-year average.

Flatbed spot rates were nearly flat, declining three-tenths of a cent after falling about 5 cents during the prior week. Rates were 1.4% below the same 2024 week and about 10% below the five-year average. As with refrigerated volume, flatbed loads rose 4.9%. Load volume was 23% above the same 2024 week but about 8% below the five-year average.