July 28, 2025

Spot rates fall again for all equipment types

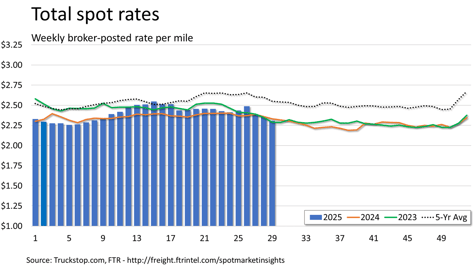

Spot rates complied with seasonal expectations in the latest week as late July reliably means falling rates. Broker-posted spot rates in the Truckstop.com system declined for all equipment types during the week ended July 25 (week 29). Dry van spot rates have erased almost all the gains from the two-week spike in late June and early July. Refrigerated spot rates are still more than 5 cents higher than they were before their mid-year surge. Flatbed spot rates were the lowest since February.

Total load activity declined 3.6%. Total volume was nearly 11% higher than it was during the same 2024 week but almost 20% below the five-year average. Total truck postings increased 4.4%, and the Market Demand Index – the ratio of load postings to truck postings in the system – fell to its lowest level in three weeks.

The total market broker-posted spot rate fell a little more than 4 cents for a second straight week. Total rates were about 1% below the same 2024 week and nearly 10% below the five-year average. With current diesel prices very close to where they were a year ago, the y/y change in rates excluding a calculated fuel surcharge was not significantly different than that for the all-in rate.

Dry van spot rates decreased by about 4 cents after declining by just over 4 cents during the previous week. Rates were nearly 2% below the same 2024 week and almost 13% below the five-year average. Dry van loads declined 5%. Volume was more than 1% below the same week last year and nearly 31% below the five-year average.

Refrigerated spot rates declined by 2.6 cents after falling 4 cents in the prior week. Rates were in line with prior-year levels at just 0.3% below the same 2024 week. As was the case in the previous week, refrigerated rates were about 8% below the five-year average for the week. Refrigerated loads decreased 6.5%. Load volume was 13.5% below the same week last year and about close to 37% below the five-year average.

Flatbed spot rates fell about 5 cents after declining about 4 cents in the previous week. Rates were 2% below the same 2024 week – the largest negative comparison since February – and close to 11% below the five-year average. Flatbed loads declined 3.1%. Load volume was almost 24% above the same 2024 week but about 13% below the five-year average.