July 21, 2025

Spot rates fall as seasonally expected

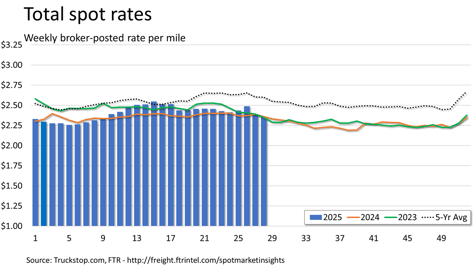

Broker-posted spot rates in the Truckstop.com system fell for all equipment types during the week ended July 18 (week 28) as is typical for mid-July. After two weeks of declines, dry van spot rates have essentially erased the spike that occurred during the week that included the Independence Day holiday. Refrigerated spot rates fell further after more than offsetting the July 4th week gain during the previous week. Flatbed spot rates decreased to their lowest level since early March.

Total load activity decreased 7.6% after rebounding by about 41% during the week following the holiday week. Total volume was about 7% higher than the same 2024 week but 18% below the five-year average. Total truck postings increased 3.6%, and the Market Demand Index – the ratio of load postings to truck postings in the system – declined after hitting its highest level in eight weeks during the previous week.

The total market broker-posted spot rate fell about 4 cents to its lowest level since March. Total rates were 0.4% below the same 2024 week and nearly 10% below the five-year average. Rates excluding a calculated fuel surcharge – an adjustment that isolates the portion of all-in rates not needed to recoup fuel costs – were nearly flat y/y at up 0.4%. In a rare situation, all three principal equipment types saw basically the same decrease in rates week over week .

Dry van spot rates decreased by more than 4 cents after dropping by more than 17 cents during the previous week. Rates were 2.6% below the same 2024 week and nearly 13% below the five-year average. Rates excluding a calculated fuel surcharge were down a little more than 2% y/y. Dry van loads declined 8.4%. Volume was about 6% below the same week last year and nearly 27% below the five-year average.

Refrigerated spot rates declined by 4 cents after plunging close to 24 cents in the week after the holiday week. Rates were about 1% below the same week last year and about 8% below the five-year average for the week. Rates excluding a calculated fuel surcharge were down 0.5% y/y. Refrigerated loads decreased 13.5%. Load volume was nearly 17% below the same week last year and about 30% below the five-year average.

Flatbed spot rates were down about 4 cents after dropping 6.5 cents in the previous week. Rates were 0.4% below the same 2024 week – only the second negative comparison in 19 weeks – and about 10% below the five-year average. Rates excluding a calculated fuel surcharge were up about 0.4% versus the same 2024 week. Flatbed loads declined 5.4%. Load volume was almost 21% above the same 2024 week but about 14% below the five-year average.