July 14, 2025

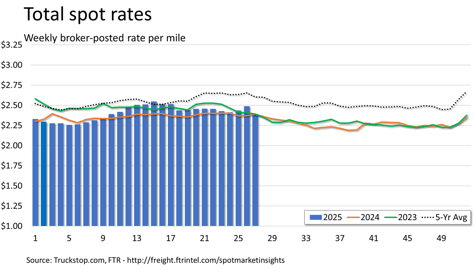

Spot rates fall back to typical levels in the latest week

A week after spot rates for van equipment saw abnormally large increases, they fell much more than usual for the week of the year. Broker-posted spot rates in the Truckstop.com system for dry van and refrigerated equipment plunged during the week ended July 11 (week 27) after huge gains during Independence Day week. Spot rates for both equipment types fell by the most during a comparable week since 2014. A drop in flatbed spot rates matched a week in May for the largest in a week since June 2023.

Total load activity rebounded 40.9% after dropping nearly 29% during the holiday week. Total volume was nearly 87% higher than 2024’s week 27, but that comparison is basically meaningless as that week last year included the Fourth of July holiday. A comparison of the two years’ weeks following the holiday week still shows a solid 16% y/y increase, however. Total truck postings increased 4.5% after falling by about 11% during the holiday week. The Market Demand Index – the ratio of load postings to truck postings in the system – rose to its highest level in seven weeks.

The total market broker-posted spot rate fell about 10 cents for the largest weekly decrease since the first week of 2023. Total rates were flat versus 2024’s week 27 but were up more than 1% versus last year’s week after July 4th week. Rates excluding a calculated fuel surcharge – an adjustment that isolates the portion of all-in rates not needed to recoup fuel costs – were nearly 3% higher than they were in 2024’s week after July 4th week.

Dry van spot rates dropped by more than 17 cents after surging more than 21 cents during the previous week. Although rates were more than 3% below 2024’s week 27 they were just 0.4% below last year’s week after July 4th week. Dry van loads jumped 42.4% after falling nearly 24% during the holiday week. Although load volume was more than 51% above that in 2024’s week 27 it was only 2.4% above volume during last year’s week after July 4th week.

Refrigerated spot rates plunged 23.5 cents after jumping more than 20 cents in the prior week. Rates were 4.5% below 2024’s week 27, but they were 0.6% higher than last year’s July 4th week. Refrigerated loads rose 11.6% after falling close to 15% during the holiday week. Load volume was 20.5% higher than in 2024’s week 27 but was almost 4% below last year’s week after July 4th week.

Flatbed spot rates fell 6.5 cents after ticking up less than a cent during the holiday week. Rates were 0.7% higher than 2024’s week 27 and up more than 1% versus last year’s week after July 4th week. Flatbed loads jumped 48.3% after falling about 34% during the holiday week. Load volume was almost 143% higher than 2024’s week 27 but a more moderate 27.4% above last year’s week after July 4th week.