July 7, 2025

Dry van and refrigerated spot rates surge

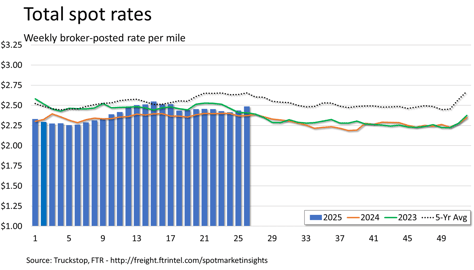

Spot rates for van equipment typically rise during the week that includes Independence Day, but this year’s mid-year peak resulted in extraordinarily large increases for both dry van and refrigerated rates. During the week ended July 4 (week 26), broker-posted dry van spot rates in the Truckstop system recorded their second largest increase for any week since at least 2008. The increase in refrigerated spot rates was much larger than typical for the week. Flatbed spot rates ticked up slightly.

The unusually large increases for dry van and refrigerated rates appear to be a function of the relative strength of spot volume in areas with higher rates. For example, among the 10 largest states by dry van spot volume, only two – California and Texas – saw rate increases smaller than the nationwide increase. Only three of those 10 – Florida, Pennsylvania, and Texas – saw dry van rates below the national average rate for the week, and Florida was the only state not close to the national dry van rate for the week.

Another unlikely but plausible contributing factor might be the new roadside enforcement policy, effective June 25, of placing drivers out of service for inadequate English skills. Such a large impact so quickly seems doubtful, but some effect is conceivable given the considerable attention given to the issue. If van spot rates were to continue rising or even just hold steady in July – a period that traditionally is soft for van rates – we might begin to consider whether a fundamental change in the market has occurred.

Total load activity fell 28.6%, although large drops in volume are typical for holiday weeks. Total volume was nearly 25% below the same 2024 week, but the comparison is misleading as last year’s week 26 was the week before Independence Day week. Load postings were up nearly 33% versus the 2024 week that included July 4. Total truck postings fell 11.1%, and Market Demand Index – the ratio of load postings to truck postings in the system – sank to its lowest level since late January.

The total market broker-posted spot rate increased 5.2 cents, which is the strongest gain in a week 26 since 2020. Total rates were about 5% higher than they were during the same 2024 week and around 4% higher than during last year’s July 4th week. Rates excluding a calculated fuel surcharge – an adjustment that isolates the portion of all-in rates not needed to recoup fuel costs – were more than 6% higher than they were a year earlier.

Dry van spot rates spiked 21.4 cents, which – at least since 2008 – is exceeded only by a late December week in 2017. Rates were about 6% above the same 2024 week and more than 5% above last year’s July 4th week. Even the smaller y/y comparison is the largest since March 2022. Excluding a calculated fuel surcharge, dry van rates were up more than 8% y/y. Dry van loads fell 23.8% during the holiday week. Volume was about 40% below the same 2024 week but more than 6% higher than last year’s July 4th week.

Refrigerated spot rates jumped 20.3 cents, which is a very large gain for a comparable week. Rates were about 8% above the same 2024 week and close to 5% above last year’s July 4th week. Excluding a calculated fuel surcharge, refrigerated rates were about 10% higher y/y. Refrigerated loads decreased 14.5% during the holiday week. Volume was about 24% above the same 2024 week and 8% higher than last year’s July 4th week.

Flatbed spot rates ticked up slightly more than half a cent. Rates were around 3% higher than both the same 2024 week and the 2024 week that included the July 4th holiday. Rates excluding a calculated fuel surcharge were up more than 4% y/y. Flatbed loads dropped 34.1%. Volume was more than 13% below the same 2024 week but almost 64% higher than last year’s July 4th week.