Van spot rates rise as expected in the latest week

Broker-posted spot rates in the Truckstop system saw their strongest overall increase in 10 weeks during the week ended June 27 (week 25) as rates rose for all equipment types. The increase for dry van spot rates was the largest in five weeks while the refrigerated spot rate gain was the largest in six weeks. Flatbed rates also ticked up slightly in a week that – in recent years, at least – usually sees lower rates. Solid gains in van equipment spot rates are almost a given during late June.

Total load activity increased 7.7% after two weeks of falling volume. Total volume was more than 16% higher than it was in the same 2024 week but still down more than 22% versus the five-year average for the week. Total truck postings ticked up 0.7%, and Market Demand Index – the ratio of load postings to truck postings in the system – was the highest in three weeks.

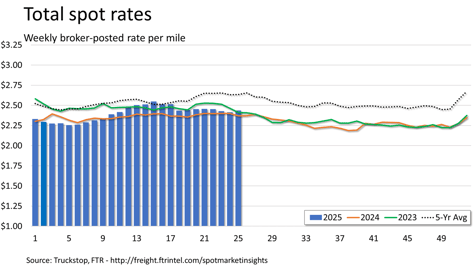

The total market broker-posted spot rate increased 2.2 cents. Total rates were about 3% higher than they were during the same 2024 week but 7.5% below the five-year average. Rates excluding a calculated fuel surcharge – an adjustment that isolates the portion of all-in rates not needed to recoup fuel costs – were more than 3% higher than they were a year earlier.

Dry van spot rates rose 5 cents. Rates were about 2% below the same 2024 week and about 12% below the five-year average for the week. Excluding a calculated fuel surcharge, dry van rates were about 3% lower y/y. Dry van loads increased 10.4%. Volume was about 8% below the same 2024 week and 32% lower than the five-year average.

Refrigerated spot rates jumped 15.2 cents. Rates were 0.4% below the same 2024 week and close to 8% below the five-year average. Excluding a calculated fuel surcharge, refrigerated rates were nearly 1% lower y/y. Refrigerated loads surged 32.2%. Volume was 1.4% above the same 2024 week – the first positive comparison in six weeks – but about 29% below the five-year average.

Flatbed spot rates inched up half a cent. Rates were more than 2% above the same 2024 week and close to 8% below the five-year average. Rates excluding a calculated fuel surcharge were up 2.5% y/y. Flatbed loads ticked up 1.7%. Volume was almost 37% higher than in the same 2024 week but down nearly 20% versus the five-year average.