Refrigerated rates recover heading into mid-year peak

Broker-posted spot rates in the Truckstop system for dry van and flatbed equipment declined during the week ended June 13 (week 23) but refrigerated spot rates increased for the first time in four weeks. The moves for all three were mostly in line with seasonal expectations. Spot rates and load volume for refrigerated and dry van equipment are expected to rise for the next couple of weeks as the market moves toward its traditional mid-year strength. Flatbed spot rates tend to soften until mid-August.

Total load activity decreased 4.1% after jumping more than 16% during the week after Memorial Day week. Total volume was more than 4% higher than it was in the same 2024 week but still down more than 25% versus the five-year average for the week. Total truck postings rose 6.5%, which was the same scope as the decrease during Memorial Day week. The Market Demand Index – the ratio of load postings to truck postings in the system – declined to its eighth lowest level of the year so far.

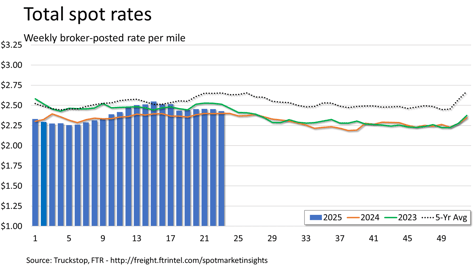

The total market broker-posted spot rate decreased 2.6 cents. Total rates were slightly more than 1% higher than they were during the same 2024 week – the weakest prior-year comparison in 14 weeks – but 8.5% below the five-year average. Rates excluding a calculated fuel surcharge – an adjustment that isolates the portion of all-in rates not needed to recoup fuel costs – were 3.6% higher than they were a year earlier.

Dry van spot rates declined 2.4 cents after decreasing 5 cents in the prior week. Rates were 1.4% below the same 2024 week – the same as the previous week’s y/y comparison – and more than 11% below the five-year average for the week. Excluding a calculated fuel surcharge, dry van rates were 1% higher y/y. Dry van loads eased 0.8%. Volume was nearly 6% below the same 2024 week and more than 28% lower than the five-year average.

Refrigerated spot rates rose 5.3 cents after falling nearly 19 cents in the prior three weeks. Rates were just barely above prior-year levels at +0.3% but down 7.5% versus the five-year average. Excluding a calculated fuel surcharge, refrigerated rates were 2.6% higher y/y. Refrigerated loads ticked up 0.5%. Volume was about 12% below the same 2024 week and close to 37% below the five-year average.

Flatbed spot rates decreased 2.9 cents after rising by basically that amount over the past two weeks. Rates were less than 1% higher than they were during the same 2024 week but about 9% below the five-year average. Rates excluding a calculated fuel surcharge were up 3% y/y. Flatbed loads declined 6.3%. Volume was more than 12% higher than in the same 2024 week but down nearly 26% versus the five-year average.