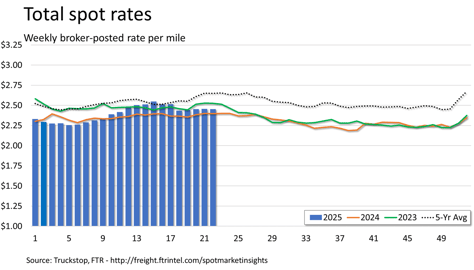

Van spot rates decline largely in line with seasonality

Broker-posted spot rates in the Truckstop system for dry van and refrigerated equipment declined during the week ended June 6 (week 22), although softening is typical between Memorial Day and the traditional run-up in rates later in the month. Flatbed spot rates barely changed. Spot volume rose for each of the principal equipment types, which is unusual for a week 22 but typical for the week after Memorial Day week. A calendar disconnect continues to distort y/y comparisons for loads somewhat .

Total load activity increased 16.4% following a drop of about 19% during Memorial Day week. Although total volume was about 24% higher than week 22 last year, that week included the holiday. Comparing the weeks following Memorial Day, load postings were up 8.7% y/y. Total truck postings were essentially unchanged versus the prior week, and the Market Demand Index – the ratio of load postings to truck postings in the system – rose .

The total market broker-posted spot rate declined three-tenths of a cent after rising by the same degree in the previous week. Total rates were slightly more than 2% higher than they were during the same 2024 week as well as versus the week after Memorial Day. Rates excluding a calculated fuel surcharge – an adjustment that isolates the portion of all-in rates not needed to recoup fuel costs – were 5.5% higher than they were a year earlier, which is the same prior-year comparison as the prior week .

Dry van spot rates decreased 5 cents after declining nearly 1 cent in the prior week. Rates were 1.4% below the same 2024 week but just 0.2% below the week after Memorial Day last year. Excluding a calculated fuel surcharge, dry van rates were 1.5% higher y/y and nearly 3% higher than the week after Memorial Day last year. Dry van loads increased 6.5%. Volume was up about 3% from the same 2024 week but 5% lower than the week after Memorial Day last year .

Refrigerated spot rates fell 4.7 cents after dropping about 13 cents during the previous week. Rates were 3.7% below the same 2024 week but 2% below rates during the week after Memorial Day last year. Excluding a calculated fuel surcharge, refrigerated rates were about 2% lower y/y but were basically flat versus the week after Memorial Day last year. Refrigerated loads increased 13.5%. Volume was 1.5% below the same 2024 week but nearly 13% lower than volume during the week after Memorial Day last year .

Flatbed spot rates ticked up just a tenth of a cent. Rates were 2.5% higher than they were during the same 2024 week and 2% higher than during the week after Memorial Day last year. Rates excluding a calculated fuel surcharge were up close to 6% from the same 2024 week and nearly 5% versus the week after Memorial Day last year. Flatbed loads jumped 21.7%. Volume was more than 41% higher than that in the same 2024 week and about 20% higher than that during the week after Memorial Day last year .