Spot volume, reefer rates still normalizing after Roadcheck

The second week following the annual International Roadcheck roadside inspection event saw a continued fading of spot market volume as well as a steep drop in refrigerated spot rates. Broker-posted spot rates in the Truckstop system were nearly flat overall during the week ended May 30 (week 21) as flatbed spot rates rose for the first time in six weeks and dry van rates declined only slightly. A fairly sharp drop in refrigerated rates during the second week following Roadcheck is common.

Total load activity fell 14.1% after dropping close to 13% in the previous week. Total volume was 16.5% below the same 2024 week, but prior-year comparisons in load postings are still distorted by the fact that the 2025 and 2024 weeks do not match precisely. Compared to the second week following Roadcheck last year, total volume was up 6.7%. Total truck postings fell 6.5%, and the Market Demand Index – the ratio of load postings to truck postings in the system – declined to its lowest level in four weeks due to the sharper drop in load postings.

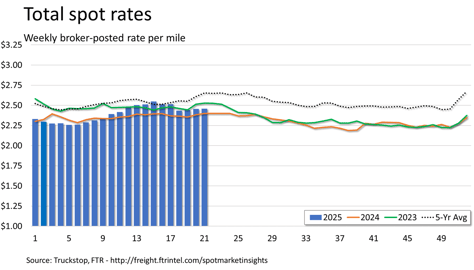

The total market broker-posted spot rate increased three-tenths of a cent. Total rates were more than 2% higher than they were during the same 2024 week as well as versus last year’s second week following Roadcheck. Rates excluding a calculated fuel surcharge – an adjustment that isolates the portion of all-in rates not needed to recoup fuel costs – were 5.5% higher than they were a year earlier.

Dry van spot rates declined less than 1 cent after rising nearly 20 cents in the prior two weeks. Rates were about 1% higher than both the same 2024 week and the second week following Roadcheck last year. Excluding a calculated fuel surcharge, dry van rates were nearly 5% higher y/y. Dry van loads fell 14.1%. Volume was down more than 16% from the same 2024 week, but it was only about 3% lower than volume during the second week after Roadcheck last year.

Refrigerated spot rates fell just over 13 cents after declining only 1 cent during the previous week. Rates were 6% below the same 2024 week, but they were less than 2% below rates during the second week following Roadcheck last year. Excluding a calculated fuel surcharge, refrigerated rates were about 5% lower y/y but were basically flat versus the second week after Roadcheck last year. Refrigerated loads dropped 26.6%. Volume was more than 29% below the same 2024 week and about 13% lower than volume during the second week after Roadcheck last year.

Flatbed spot rates increased just under 3 cents. Rates were about 3% higher than they were during the same 2024 week and 2.5% higher than during the second week after Roadcheck last year. Rates excluding a calculated fuel surcharge were up more than 6% from the same 2024 week and more than 5% versus the second week after Roadcheck last year. Flatbed loads fell 20.6%. Volume was 6.5% below that in the same 2024 week, but it was more than 16% above that during the second week after Roadcheck last year.