Van spot rates surge during International Roadcheck week

Broker-posted spot rates in the Truckstop system for dry van and refrigerated equipment soared during the week ended May 16 (week 19) due to the annual International Roadcheck roadside inspection event, which was held May 13-15. However, spot rates fell for flatbed equipment – unusual for a Roadcheck week. Both dry van and refrigerated saw their largest spot rate increases in a single week since 2023’s Roadcheck week. Total spot load volume rose by the most in a week since the first week of this year.

Note: As we pointed out in early January, due to calendar quirks, a year occasionally ends up with 53 weeks in the data as happened in 2024. Therefore, 2025 weeks do not match up cleanly with 2024 weeks. This disconnect does not matter much for most weeks of the year, but due to the big annual distortion caused by International Roadcheck, the following commentary compares results for the 2025 and 2024 Roadcheck weeks even though they are different weeks of their respective years. Similarly, next week’s analysis will compare the week following Roadcheck in both years.

Total load activity jumped 34.4% as International Roadcheck idled many truck drivers and disrupted route guide freight, sending much more volume to the spot market. Total volume was 2.4% above that in 2024’s Roadcheck week, which occurred during week 20. Total truck postings fell 7.1%, which is the largest decrease since the fifth week of this year. The Market Demand Index – the ratio of load postings to truck postings in the system – rose to its highest level in six weeks. All equipment types saw higher MDIs, but the MDI for refrigerated equipment skyrocketed to one of its highest levels on record and the highest since the beginning of 2022.

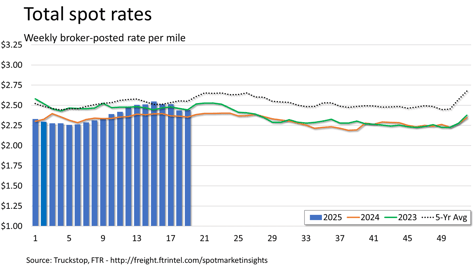

The total market broker-posted spot rate ticked up less than a cent as a decrease in flatbed rates offset most of the gains in van equipment. Total rates were 2.4% higher than they were in 2024’s International Roadcheck week. Rates excluding a calculated fuel surcharge – an adjustment that isolates the portion of all-in rates not needed to recoup fuel costs – were about 6% higher than they were the week of last year’s Roadcheck. During the week after Roadcheck, dry van and flatbed spot rates usually rise week over week, but refrigerated rates fall in most years. However, refrigerated spot rates increased in the weeks following Roadcheck both last year and in 2022.

Dry van spot rates rose 12.3 cents to their highest level in more than 12 weeks. Rates were essentially the same as those recorded during International Roadcheck in 2024. Excluding a calculated fuel surcharge, dry van rates were 4% higher than they were during 2024’s Roadcheck week. Dry van loads jumped 44.6%. Volume was about 7% above that during Roadcheck week last year.

Refrigerated spot rates surged 27.6 cents to their highest level in 17 weeks. Rates were less than 1% higher than those posted during 2024’s International Roadcheck week. Excluding a calculated fuel surcharge, refrigerated rates were, like dry van, up 4% versus last year’s Roadcheck week. Refrigerated loads surged 50.5%. Volume was more than 12% higher than during the 2024 Roadcheck week.

Flatbed spot rates fell 3.2 cents for a fourth straight decrease. Rates, which had not fallen during a Roadcheck week since 2012, were more than 2% higher than they were during the 2024 Roadcheck week. Rates excluding a calculated fuel surcharge were up about 6% versus those during last year’s Roadcheck week. Flatbed loads rose 29.7%. Volume was close to 28% above that during the 2024 Roadcheck week.