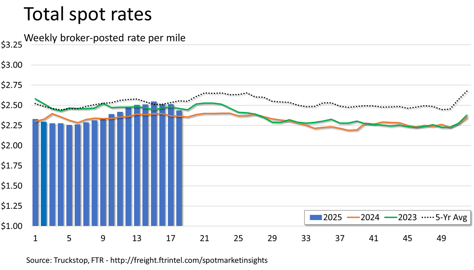

Spot rates fall sharply in the latest week

Broker-posted spot rates in the Truckstop system fell substantially for all equipment types during the week ended May 9 (week 18). Dry van spot rates fell to their lowest level since June 2020. After a sharp increase in the previous week, refrigerated spot rates fell by the most in 12 weeks. Flatbed spot rates saw their largest week-over-week drop since June 2023. Higher spot rates during the current week are virtually a lock due to the annual International Roadcheck roadside inspection event.

Total load activity fell 10.6% after a minor uptick in the previous week. Total volume was 1.6% above the same 2024 week but nearly 33% below the five-year average for the week. Total truck postings rose 2.8%, and the Market Demand Index – the ratio of load postings to truck postings in the system – fell to its lowest level since mid-February.

The total market broker-posted spot rate fell 8 cents – the largest drop since the first week of 2023. The total market rate decrease exceeded that of any of the principal equipment types mostly because volume for flatbed, which has the highest rates of the three by far, fell more sharply than did volume for van equipment. Total rates were about 3% higher y/y but were down close to 5% versus the five-year average for the week. Rates excluding a calculated fuel surcharge – an adjustment that isolates the portion of all-in rates not needed to recoup fuel costs – were up close to 8% y/y. The current week (week 19) includes Roadcheck, which is scheduled for May 13-15. Many truck drivers take time off during Roadcheck to avoid the hassle and scrutiny of additional roadside inspections, and the result invariably is higher spot rates.

Dry van spot rates decreased nearly 4 cents after rising almost 1.5 cents in the previous week. Rates, which have fallen in 13 of the 18 weeks in 2025 so far, were more than 3% below the same 2024 week and about 12% below the five-year average for the week. Excluding a calculated fuel surcharge, dry van rates were up about 1% y/y. Dry van loads declined 3.4%. Volume was more than 7% below the same 2024 week and more than 38% below the five-year average.

Refrigerated spot fell nearly 7 cents after rising close to 10 cents during the prior week. Rates, which have fallen in 12 of the 18 weeks in 2025 so far, were 7% below the same 2024 week and about 13% below the five-year average for the week. Excluding a calculated fuel surcharge, refrigerated rates were down nearly 5% y/y. Refrigerated loads decreased 7.3%. Volume was nearly 12% below the same 2024 week and almost 43% below the five-year average.

Flatbed spot rates fell 6.5 cents for a third straight decrease, which had not occurred since November. Rates were 4% above the same 2024 week – the weakest comparison in eight weeks – but more than 3% below the five-year average for the week. Rates excluding a calculated fuel surcharge were up almost 9% y/y. Flatbed loads dropped 13.7%. Volume was about 8% above the same 2024 week but more than 32% below the five-year average.