Spot rates decline for all equipment types in the latest week

Broker-posted spot rates in the Truckstop system decreased for all equipment types during the week ended April 25 (week 16) as flatbed spot rates declined for the first time in 11 weeks. Dry van spot rates remained above their level in June 2020 but only by less than 1 cent. Refrigerated spot rates were down after the prior week’s sharp increase. Total load postings increased after two weeks of sharp decreases due mostly to flatbed, suggesting that a likely distortion related to tariffs has faded for now.

Broker-posted spot rates in the Truckstop system decreased for all equipment types during the week ended April 25 (week 16) as flatbed spot rates declined for the first time in 11 weeks. Dry van spot rates remained above their level in June 2020 but only by less than 1 cent. Refrigerated spot rates were down after the prior week’s sharp increase. Total load postings increased after two weeks of sharp decreases due mostly to flatbed, suggesting that a likely distortion related to tariffs has faded for now.

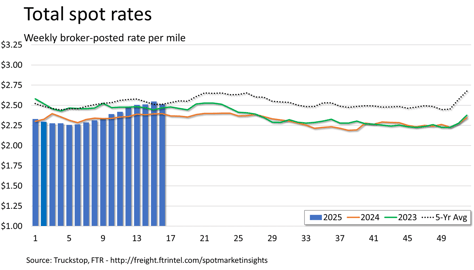

The total market broker-posted spot rate was down more than 3 cents for the first decrease in 11 weeks. Total rates were up about 5% y/y and were flat versus the five-year average for the week. Rates excluding a calculated fuel surcharge – an adjustment that isolates the portion of all-in rates not needed to recoup fuel costs – were up more than 10% y/y. During the current week (week 17) of the year, spot rates historically have risen more often than not for the principal equipment types, although recent years have been inconsistent.

Dry van spot rates decreased less than 1 cent. Rates were 1.5% below the same 2024 week and nearly 9% below the five-year average for the week. Excluding a calculated fuel surcharge, dry van rates were up nearly 4% y/y. Dry van loads rose 14.8% – the largest increase since the beginning of the year – after sizable drops in the two previous weeks. Volume was about 2% below the same 2024 week and nearly 26% below the five-year average.

Refrigerated spot rates declined 2.5 cents. Rates were nearly 1% above the same 2024 week but were more than 6% below the five-year average for the week. Excluding a calculated fuel surcharge, refrigerated rates were up about 6% y/y. Refrigerated loads increased 3.7%. Volume was nearly 7% above the same 2024 week but more than 25% below the five-year average.

Flatbed spot rates decreased 2.5 cents. Rates were more than 5% above the same 2024 week and nearly 1% above the five-year average for the week. Rates excluding a calculated fuel surcharge were up more than 10% y/y. Flatbed loads increased 4.1% after dropping about 15% in each of the previous two weeks. Volume was more than 24% above the same 2024 week but close to 18% below the five-year average.