Spot rates post solid gains in the latest week

Broker-posted spot rates in the Truckstop system rose strongly during the week ended December 20 (week 51), especially for van equipment. The total market rate rose by the most since early October’s hurricane-related stress. Dry van’s gain basically matched its increase then. Refrigerated spot rates also were strong but have seen a couple of slightly larger gains since mid-October. Week 51 normally sees larger increases in van spot rates, but the week’s end usually is closer to Christmas.

Total load activity increased 2.5%. Volume was up 31% from the same 2023 week but close to 8% below the five-year average for the week. Timing likely factored substantially into the strong y/y comparison. Last year’s week 51 ended on December 22 – the final weekday before Christmas – so volume probably was closer to winding down for the holiday than it was this year. Total truck postings declined 4.5% – a much smaller decrease than is typical for week 51. The Market Demand Index – the ratio of load postings to truck postings in the system – increased but did not match the level two weeks earlier.

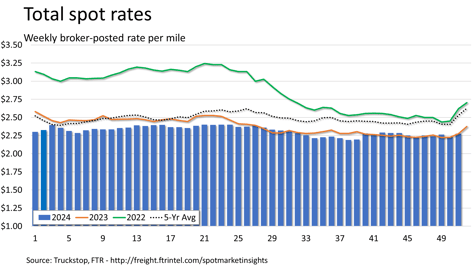

The total broker-posted spot rate rose 4.7 cents for the strongest increase in 11 weeks. Although the week-over-week increase was only slightly smaller than the one in week 51 last year, it was much smaller than usual for the week. Over the past decade, the average spot rate increase during week 51 has been about 12 cents. However, as noted above, week 51 usually falls closer to Christmas, resulting in robust rate increases due to a drop in active driver capacity. Rates were flat versus the same week last year and 10% below the five-year average for the week. The mid-week timing of Christmas this year could produce stronger van rate increases than usual for week 52 due to an elongated impact on capacity.

Dry van spot rates increased more than 7 cents after declining 2.5 in the previous week. Rates, which were at their highest level since the third week of 2024 when they were elevated due to winter weather, were more than 3% higher than the same 2023 week but nearly 12% below the five-year average. Dry van loads ticked up 0.3%. Volume was nearly 20% higher than in the same week last year but more than 14% below the five-year average.

Refrigerated spot rates jumped just over 9 cents after falling more than 13 cents during the prior week. Rates were 3.6% above the same 2023 but about 13% below the five-year average for the week. Refrigerated loads rose 16.8%. Volume was more than 14% above last year’s week 51 but close to 29% below the five-year average.

Flatbed spot rates increased 2 cents, basically the same scope as the prior week’s decrease. Rates, which have risen in every week 51 since 2012, were more than 2% below the same week last year and 8.5% below the five-year average. Flatbed loads eased 0.4%. Volume was more than 48% higher than in the same week last year and nearly 1% above the five-year average.