Spot rates rise for key equipment types

For the first time since mid-October, all three principal equipment types saw increases in broker-posted spot rates in the Truckstop system during the week ended December 6 (week 49). Refrigerated spot rates rose sharply after the prior week’s big drop had wiped out four weeks of gains. Flatbed spot rates saw their strongest increase since early October following Hurricane Helene. The increase in dry van spot rates did not match week 48’s gain but otherwise was the strongest since mid-October.

Total load activity soared 106.2%, which is a normal rebound for the week following Thanksgiving week. Last year, volume surged more than 113% during the week after Thanksgiving. Volume was nearly 20% higher than the same 2023 week, but this year’s late Thanksgiving appears to be a major factor. Volume was up 1% versus last year’s week after Thanksgiving, which was week 48. Prior-year comparisons in volume should be more meaningful beginning this week. Total truck postings increased just 2.1% during the week after the holiday, and the Market Demand Index – the ratio of load postings to truck postings in the system – jumped to its highest level since the end of June.

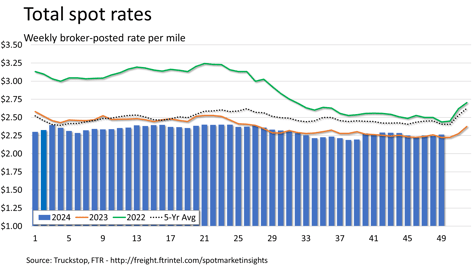

The total broker-posted spot rate increased more than 2 cents for the strongest gain in seven weeks and only the second increase during that period. Rates were 1.7% higher than during the same 2023 week. Distortions due to holiday timing were not as great for rates as they were for volume. Rates were up 0.2% versus last year’s week after Thanksgiving (week 48). Spot rates traditionally would be soft this week and next before surging during the final couple of weeks of the year due to capacity shortfalls.

Dry van spot rates increased 4.5 cents after rising 5.6 cents in the previous week. Rates were 3.7% higher than 2023’s week 49 but were 0.3% below 2023’s week after Thanksgiving. Last year, dry van rates during the week after Thanksgiving were at their highest level between February and the yearend surge. This year saw largely the same pattern, although rates in early July were marginally higher than they were in the latest week. Dry van loads surged 97.4% after the Thanksgiving lull. Volume was 3.6% higher than last year’s week 49 but was nearly 19% below last year’s week after Thanksgiving.

Refrigerated spot rates rose 7.6 cents after plunging 22 cents in the prior week. Rates were nearly 10% above 2023’s week 49 and about 4% higher than 2023’s week after Thanksgiving. Refrigerated’s week-over-week increase is unusual even considering the disruption due to Thanksgiving’s timing. Typically, refrigerated spot rates peak before Thanksgiving and fade steadily until the yearend surge. Refrigerated loads rose 66.3%. Volume was 28% above last year’s week 49 but was only 7.5% above last year’s week after Thanksgiving.

Flatbed spot rates increased about 2 cents after ticking up about 1 cent in the previous week. Rates were about 2% below both 2023’s week 49 and last year’s week after Thanksgiving. Flatbed loads jumped 138.4% following the Thanksgiving lull. Volume was nearly 36% above last year’s week 49 and about 21% above last year’s week after Thanksgiving.