Spot rates were soft in the latest week

Broker-posted spot rates in the Truckstop system either declined or barely rose during the week ended November 15 (week 46), depending on equipment type. Dry van and flatbed rates decreased, though by less than they had in the previous week. Refrigerated rates increased slightly. Although all three lagged usual week 46 moves, the comparability of spot metrics to prior years is getting fuzzier as Thanksgiving approaches. Thanksgiving usually falls in week 47, but this year it will fall in week 48.

Total load activity fell 9.7% after declining by nearly 2% in the previous week. Load postings were 4% higher than the same 2023 week but about 28% below the five-year average. Given that Thanksgiving fell during week 47 last year, load postings for the current week are certain to outperform those in the same week last year by a large degree. Total truck postings ticked up 0.7%, and the Market Demand Index – the ratio of load postings to truck postings in the system – fell to its lowest level in eight weeks.

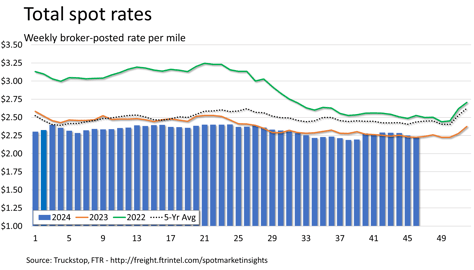

The total broker-posted rate decreased 2 cents after declining more than 3 cents during the prior week. Rates were 0.2% above the same 2023 week but more than 8% below the five-year average. Spot rates excluding a calculated fuel surcharge were about 8% higher than the same 2023 week and were higher y/y for all equipment types. The current week (week 47) usually sees stronger dry van rates and weaker refrigerated rates, but as noted earlier, the timing of Thanksgiving will disrupt y/y comparability for the next few weeks.

Dry van spot rates eased 1 cent after falling 4.4 cents in the prior week. Rates were 2.5% above the same 2023 week but close to 12% below the five-year average for the week. Excluding an imputed fuel surcharge, rates were about 13% higher than during the same 2023 week. Dry van loads fell 8.9%. Volume was 13% lower than the same week last year and about 41% below the five-year average for the week.

Refrigerated spot rates ticked up 1 cent after rising 4.6 cents during the previous week. Rates, which rose for a third straight week for the first time in a year, were slightly more than 2% above the same 2023 week but close to 9% below the five-year average. Rates excluding an imputed fuel surcharge were up nearly 10% y/y. Refrigerated loads declined 2.4%. Volume was down about 6% from the same 2023 week and was about 36% below the five-year average for the week.

Flatbed spot rates fell a bit more than 3 cents after falling 4 cents in the prior week. Rates were nearly 2% below the same 2023 week and more than 7% below the five-year average for the week. Rates excluding an imputed fuel surcharge were up about 5% y/y. Flatbed loads fell 11.6%. Volume was more than 25% above the same week last year but close to 20% below the five-year average.