Spot rates rise for all equipment types in the latest week

The aftermath of Hurricane Milton likely was a factor, but regional data suggests broader market strength as broker-posted spot rates in the Truckstop system rose for all equipment types during the week ended October 18 (week 42). Dry van spot rates increased for a fourth straight week for the first time since May 2021, and refrigerated spot rates saw their second-largest gain since May. Flatbed spot rates were positive y/y – barely – for only the third time this year.

Total load activity rose 6.8% after barely moving during the previous week. Load postings were nearly 25% higher than the same 2023 week – the strongest y/y comparison since early 2022 – and even exceeded volume in the same 2022 week slightly. Loads were about 14% below the five-year average for the week. Total truck postings increased 3.9%, and the Market Demand Index – the ratio of load postings to truck postings in the system – rose to its highest level in 13 weeks, exceeding the five-year average for the week slightly.

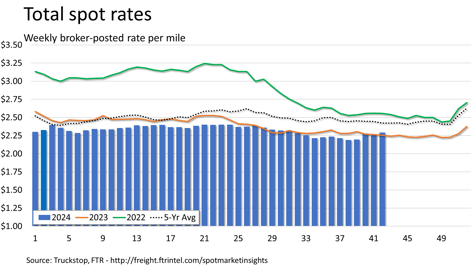

The total broker-posted rate increased 2.7 cents after declining more than 1 cent in the prior week. The rate increase was the first in a week 42 since 2016. Rates were 1.7% above the same 2023 week for the second-strongest y/y comparison this year but were more than 5% below the five-year average. Spot rates excluding a calculated fuel surcharge were more than 10% higher than the same 2023 week and were positive y/y for all equipment types. The current week (week 43) usually sees lower overall rates week over week, but history varies by equipment type.

Dry van spot rates increased 6.5 cents after moving up just over 1 cent during the previous week. Rates were 3.5% above the same 2023 week for the strongest y/y comparison since March 2022 but were nearly 9% below the five-year average for the week. Excluding an imputed fuel surcharge, rates were 15% higher than during the same 2023 week. Dry van loads rose 9.9%. Volume was about 2% above the same 2023 week – the strongest y/y comparison since July – but about 30% below the five-year average.

Refrigerated spot rates rose 10.5 cents after easing almost 1 cent in the prior week. Rates were nearly 4% above the same 2023 week – the strongest y/y comparison since July – but about 5% below the five-year average. Rates excluding an imputed fuel surcharge were up 12.7% y/y. Refrigerated loads rose 15.9% for the strongest weekly gain since the weather-impacted week 3 this year. Volume was nearly 13% above the same 2023 week – the strongest y/y comparison since January – but more than 22% below the five-year average for the week.

Flatbed spot rates increased 1.3 cents after falling nearly 3 cents in the previous week. Rates, which increased for only the second time in a week 42 in 12 years, were 0.4% above the same 2023 week but more than 5% below the five-year average for the week. Rates excluding an imputed fuel surcharge were up 8.3% y/y. Flatbed loads increased 3.8%. Volume was more than 47% above the same week last year – the strongest y/y comparison since August 2021 – but more than 6% below the five-year average.