Van spot rates see seasonal decline but remain higher y/y

Broker-posted spot rates in the Truckstop system continued to ease as expected during the week ended July 19 (week 29), but rates for both dry van and refrigerated equipment remain higher than they were during the same week last year. The last time either dry van or refrigerated experienced any meaningful increase in spot rates during week 29 was 2009. Flatbed spot rates, which also declined week over week, were up nearly 1% y/y for the first positive y/y comparison since late July 2022.

Total load activity declined 6.5% after surging 61% during the week following the Independence Day holiday. Total volume was 7% above the same 2023 week but nearly 27% below the five-year average for the week. Total truck postings rose about 10%, and the Market Demand Index – the ratio of load postings to truck postings in the system – declined to its lowest level since February except for the week that included the Fourth of July holiday.

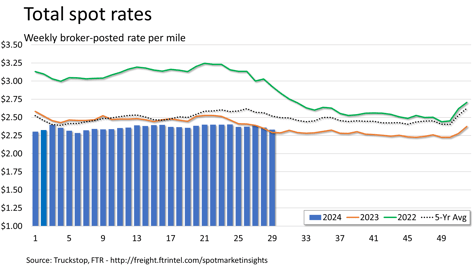

The total broker-posted rate decreased nearly 3 cents after declining by essentially the same amount in the previous week. Total rates were nearly 2% above the same 2023 week – the strongest y/y comparison since early June 2022 – but more than 7% below the five-year average for the week. The period between the Fourth of July and early August tends to be a soft period for spot rates, especially for van equipment.

Dry van spot rates decreased nearly 6 cents after declining by basically the same amount in the prior week. The only time since 2009 that broker-posted dry van spot rates have increased week over week during week 29 was in 2020, but that gain was a mere tenth of cent. Rates were up a little more than 2% y/y but were still down about 10% versus the five-year average. Dry van loads fell 9.7%. Volume was more than 5% above the same 2023 week but nearly 28% below the five-year average for the week.

Refrigerated spot rates declined 4.6 cents after falling nearly 13 cents during the previous week. Rates, which have not risen week over week during week 29 since 2009, were nearly 5% above the same 2023 week but were nearly 6% below the five-year average. Refrigerated loads decreased 10%. Volume was about 1% below the same 2023 week and 25% below the five-year average for the week.

Flatbed spot rates declined more than 1 cent after a decrease of basically the same amount during the prior week. Rates, which have risen week over week only twice in week 29 since 2009, were up about 1% from the same 2023 week but down about 7% versus the five-year average. Flatbed loads declined 5.4% after surging more than 90% during the week following the holiday. Volume was about 23% above the same week last year but about 30% below the five-year average for the week.