Refrigerated spot rates dip in a typically strong week

Total broker-posted spot rates in the Truckstop system ticked up slightly during the week ended June 28 (week 26), but refrigerated spot rates eased a bit in a week that typically sees one of the largest increases of the year. The week-over-week increase in dry van spot rates also was weaker than usual, but refrigerated rates have not decreased during week 26 since 2012. With Independence Day falling on Thursday, it is possible that spot rates this week will be stronger than usual, however.

Total load activity increased 10.2% after a gain of 2.5% during the previous week. Total volume was about 7% above the same 2023 week – the strongest y/y comparison since April – but more than 25% below the five-year average for the week. Total truck postings declined 0.7%, and the Market Demand Index – the ratio of load postings to truck postings in the system – rose to its highest level in three weeks. However, the MDI for dry van equipment was the strongest since January 2023 while the refrigerated MDI also was the strongest since January 2023 except for the third week of this year due to the weather disruption.

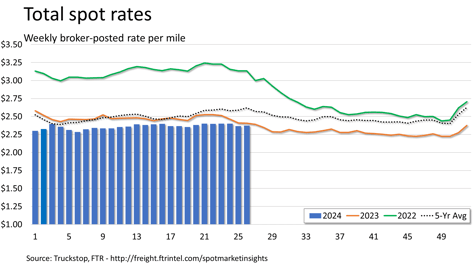

The total broker-posted rate increased four-tenths of a cent after declining more than 3 cents during the prior week. Total rates were 1.5% below the same 2023 week and 9.5% below the five-year average for the week. Although the increase in the total market rate was small, it was the first week-over-week gain in week 26 since 2021.

Dry van spot rates rose nearly 5 cents after rising more than 5 cents during the previous week. The increase was the smallest for week 26 since 2015. The average increase for the week in 2014 through 2023 was 9.7 cents. Rates were 0.5% below the same 2023 week and nearly 11% below the five-year average. Dry van loads jumped 16.9%. Volume was nearly 7% above the same 2023 week – the strongest y/y comparison since January – but almost 17% below the five-year average for the week.

Refrigerated spot rates declined three-tenths of a cent after jumping more than 9 cents during the prior week. The average rate increase during 2014-2023 was 12.3 cents. However, the week 25 increase was stronger than the 6.3-cent average during the same period. Therefore, if rates hold up better than usual during the current week – the average decrease was nearly 15 cents during 2014-2023 – refrigerated rates might remain at least on par with last year in the weeks ahead. Rates were nearly 2% below the same 2023 week and more than 9% below the five-year average. Refrigerated loads rose 14%. Volume was more than 1% above the same 2023 week but 24% below the five-year average for the week.

Flatbed spot rates declined more than 1 cent after falling nearly 6 cents in the previous week. However, flatbed rates performed better than they did in 2023's week 26 when they fell 3.6 cents. Rates were only about 1% below the same 2023 week, which is the strongest y/y comparison since July 2022 when rates were positive y/y. Rates were about 9% below the five-year average. Flatbed loads rose 4.1%. Volume was more than 12% above the same week last year but about 35% below the five-year average for the week.