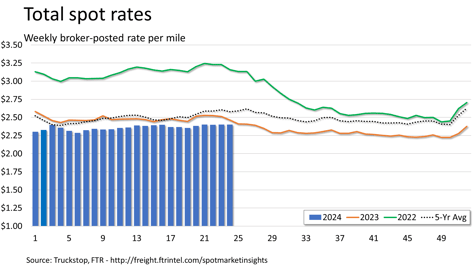

Total spot rates are basically steady for a third straight week

Although rates increased for two of the three principal equipment types, total broker-posted spot rates in the Truckstop system were essentially unchanged during the week ended June 14 (week 24) due to changes in the freight mix. Total rates had barely moved in the previous two weeks. Refrigerated spot rates rose after two down weeks, and flatbed rates were up for a fifth straight week – a streak that had not occurred in more than two years. Dry van rates eased marginally from the prior week.

Total load activity fell 8.4% after rising more than 14% during the first full week following the Memorial Day holiday. Total volume was more than 5% below the same 2023 week and more than 35% below the five-year average for the week. Flatbed was a drag on volume as both dry van and refrigerated load postings were higher y/y in the latest week. Total truck postings rose 5%, and the Market Demand Index – the ratio of load postings to truck postings in the system – fell.

The total broker-posted rate was unchanged from the previous week. Rates were 2.6% below the same 2023 week and about 7% below the five-year average for the week. Total rates were flat despite higher flatbed and refrigerated rates and barely any change in dry van rates largely because of a substantial drop in volume for flatbed, which has the highest rates. If total rates were to continue holding steady, by week 27 they would be higher y/y for the first time since June 2022.

Dry van spot rates declined by less than a tenth of a cent after falling 2.5 cents during the prior week. Rates were 0.2% above the same 2023 week but 10% below the five-year average. Dry van loads declined 1.4%. Volume was 1.5% above the same 2023 week but more than 30% below the five-year average for the week.

Refrigerated spot rates rose nearly 4 cents after falling slightly more than 4 cents in the previous week. Rates were nearly 1% above the same 2023 week but more than 6% below the five-year average for the week. Refrigerated loads increased 2.3%. Volume was nearly 8% above the same 2023 week – the strongest y/y comparison since January – but about 29% below the five-year average for the week.

Flatbed spot rates rose just over 1 cent after rising by a slightly larger amount during the prior week. The last time that flatbed spot rates increased in more than four consecutive weeks was April 2022. Rates were 2.4% below the same 2023 week – the least negative y/y comparison since August 2022 – and 6% below the five-year average for the week. Unless flatbed rates fall by about a cent or more in the current week, they will be higher y/y in week 25. Flatbed loads fell 14.2%. Volume was nearly 12% below the same week last year and 42% below the five-year average for the week.