Total spot rate barely moves in the latest week

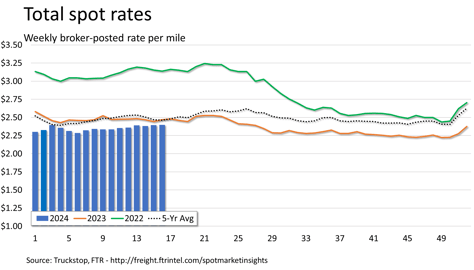

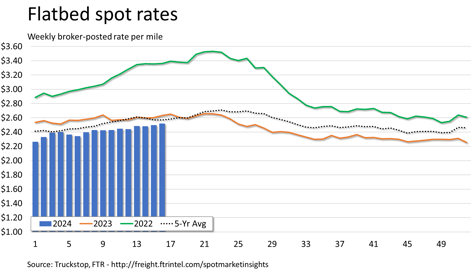

The total broker-posted rate in the Truckstop system ticked up a fraction of a cent during the week ended April 19 (week 16) as an increase in flatbed rates roughly offset declines in dry van and refrigerated rates. The total market rate was at its highest level since the end of June, but rates for van equipment were at their lowest levels in about a year. Flatbed rates were at their highest level since January of last year. Even so, van rates were slightly higher y/y while flatbed rates were down.

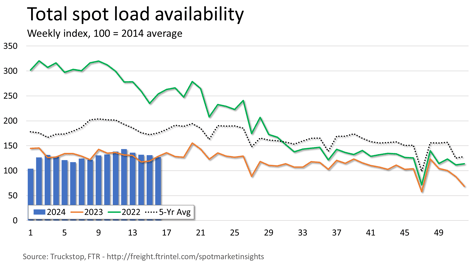

Total load activity declined 3% after easing 0.6% during the previous week. Total volume was down more than 1% from the same 2023 week and was nearly 28% below the five-year average for the week. Total truck postings rose 6.3%, and the Market Demand Index – the ratio of load postings to truck postings in the system – declined to its lowest level in seven weeks.

The total broker-posted rate ticked up four-tenths of a cent after moving up slightly more than 1 cent during the prior week. Rates were nearly 3% below both the same 2023 week and the five-year average for the week. Spot rates will get a boost in several weeks due to the Commercial Vehicle Safety Alliance’s International Roadcheck inspection event, which is scheduled for May 14-16. Even in a weak market like last year, Roadcheck fueled a jump in spot rates that largely reset van rates for much of the rest of 2023.

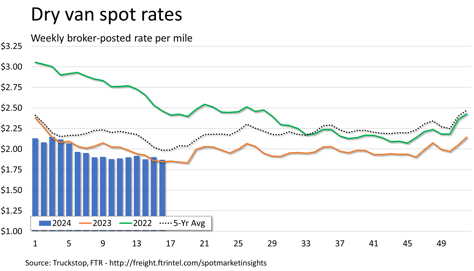

Dry van spot rates fell 3.4 cents after rising 2.6 cents in the previous week. Rates, which were at their lowest level since the week before last year’s Roadcheck event, were more than 1% above the same 2023 week but about 6% below the five-year average. Dry van loads declined 3%. Volume was more than 5% below the same 2023 week and about 22% below the five-year average for the week.

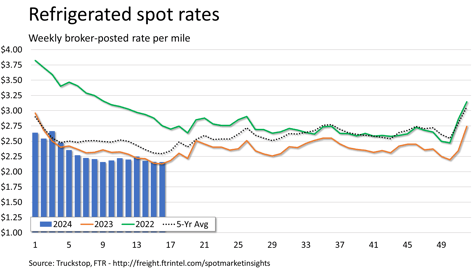

Refrigerated spot rates declined six-tenths of a cent after decreasing more than 1 cent during the prior week. Rates, which were at their lowest level in exactly a year, were more than 1% above the same 2023 week but 6% below the five-year average for the week. Refrigerated loads increased 5.8%. Volume was less than 1% below the same 2023 week but about 31% below the five-year average for the week.

Flatbed spot rates increased 2 cents following a gain of basically the same amount in the previous week. Rates were more than 4% below the same 2023 week and 2% below the five-year average for the week. Flatbed loads fell 5.6%. Volume was less than 1% higher than the same week last year but about 33% below the five-year average for the week.