Spot rates tick up in the latest week

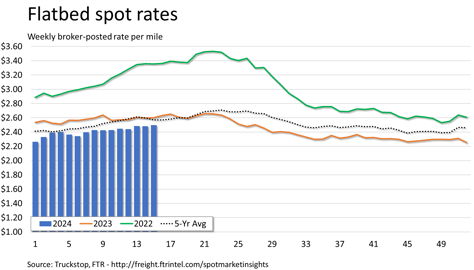

The total broker-posted rate in the Truckstop system during the week ended April 12 (week 15) basically recovered its small decline during the prior week. Dry van and flatbed spot rates increased while refrigerated rates decreased. Flatbed rates were at their highest level since early July. Refrigerated rates were about a half cent higher than in week 9 but otherwise were the lowest in just under a year. Total load volume barely moved and has been above comparable 2023 levels for five straight weeks.

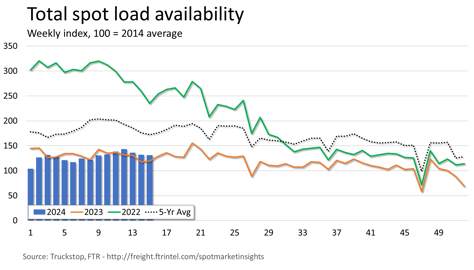

Total load activity eased 0.6% after falling about 3% during the previous week. Total volume was up nearly 10% from the same 2023 week but almost 24% below the five-year average for the week. Total truck postings ticked up 0.9%, and the Market Demand Index – the ratio of load postings to truck postings in the system – declined slightly.

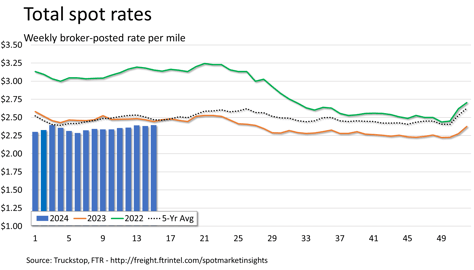

The total broker-posted rate edged up slightly more than 1 cent after easing just under 1 cent during the prior week. Rates were 2% below the same 2023 week – the least negative y/y comparison since July 2022 – and 3% below the five-year average for the week.

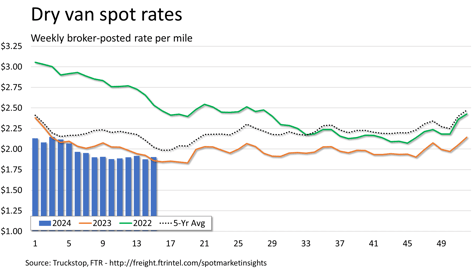

Dry van spot rates increased 2.6 cents after falling about 4 cents in the previous week. Rates were 2.4% above the same 2023 week for the strongest y/y comparison since April 2022. Only two weeks since then have seen rates at all higher y/y, and those were during the winter weather event in January. Dry van rates were 6% below the five-year average, however. Dry van loads increased 4.3%. Volume was less than 3% above the same 2023 week but nearly 19% below the five-year average for the week.

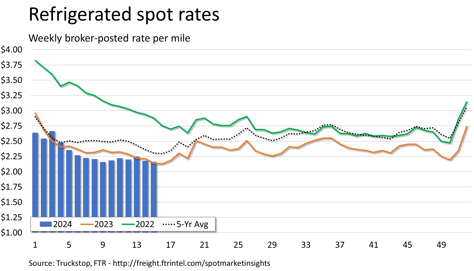

Refrigerated spot rates declined more than 1 cent after falling about 7 cents during the prior week. Rates were 1% above the same 2023 week but more than 6% below the five-year average for the week. Refrigerated loads increased 3.7%. Volume was about 2% below the same 2023 week and about 33% below the five-year average for the week.

Flatbed spot rates increased about 2 cents after easing six-tenths of a cent in the previous week. Rates were nearly 3% below the same 2023 week and about 4% below the five-year average for the week. Flatbed loads declined 3.9%. Volume was nearly 18% higher than the same week last year but about 18% below the five-year average for the week.