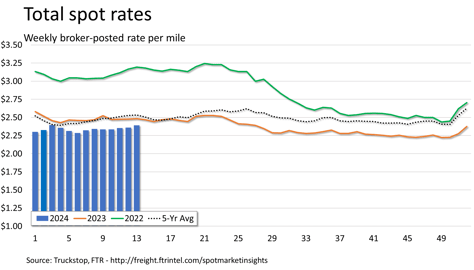

Total spot rates rise for the fourth straight week

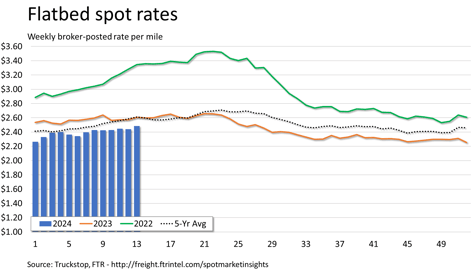

The total broker-posted spot market rate in the Truckstop system rose by the most since mid-February during the week ended March 29 (week 13). Total rates have increased for four straight weeks – a streak that most recently occurred exactly two years ago – although the total gain during the stretch has been less than 6 cents. The increases for dry van and refrigerated spot rates were the largest since the weather-impacted third week of this year. Flatbed spot rates were the strongest since early July 2023.

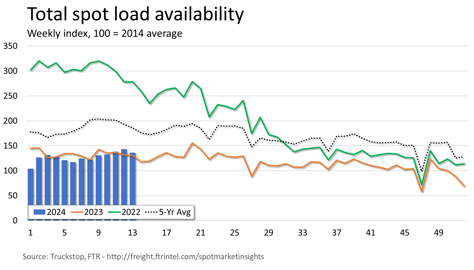

Total load activity decreased 5.2% after increases in four straight weeks. Total volume was up 4% from the same 2023 week but about 27% below the five-year average. Truck postings decreased 3.2%, and the total Market Demand Index – the ratio of loads to trucks – eased slightly. The dry van and refrigerated MDIs increased slightly, but the flatbed MDI declined after rising for eight straight weeks.

The total broker-posted rate increased just over 3 cents for the largest gain since week 7. Rates were less than 4% below the same 2023 week and nearly 6% below the five-year average for the week. The total market rate, which was the highest since early July largely on the strength of flatbed rates, has declined only once in the past seven weeks.

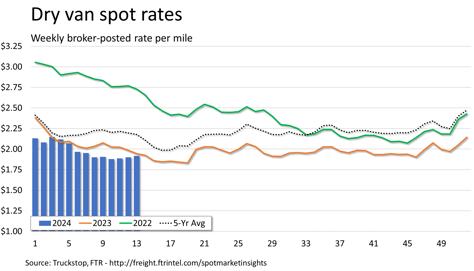

Dry van spot rates increased 1.6 cents after rising by nearly the same amount in the previous week. Rates, which were up for three straight weeks for the first time since September, were only 1.5% below the same week last year and 12% below the five-year average for the week. Dry van loads declined 2%. Volume was about 5% below the same 2023 week and more than 30% below the five-year average for the week.

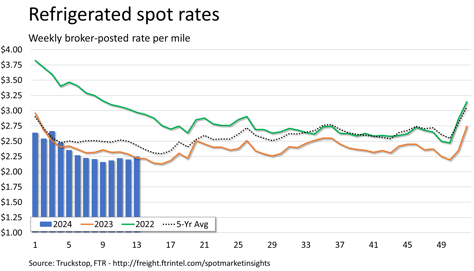

Refrigerated spot rates rose nearly 5 cents and were up for the third time in four weeks. Rates were just over 1% above the same 2023 week but nearly 8% below the five-year average for the week. Food demand related to Easter might have been a factor in the latest week’s rate increase, although volume was down. Refrigerated loads fell 7.5%. Volume was 4% below the same 2023 week and nearly 34% below the five-year average for the week.

Flatbed spot rates rose 4.5 cents – the largest increase since week 7. Rates, which have decreased week over week only four times this year, were nearly 5% below both the same week last year and the five-year average for the week. Flatbed loads fell 6.8%. Volume was nearly 13% higher than the same week last year but was about 27% below the five-year average for the week.