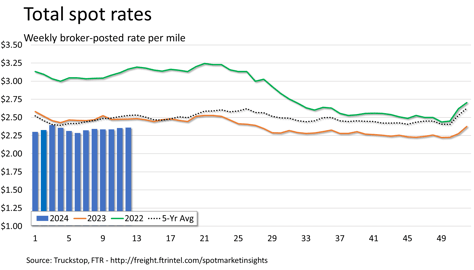

Total spot rates are slightly higher in the latest week

The total broker-posted spot market rate in the Truckstop system edged higher during the week ended March 22 (week 12). Total rates have risen for three straight weeks – the first streak of that length this year – although the cumulative increase over that period is less than 3 cents. Dry van spot rates increased while refrigerated and flatbed rates declined. Total load postings rose in the latest week, but a sharp increase in flatbed volume offset decreases in volume for van equipment.

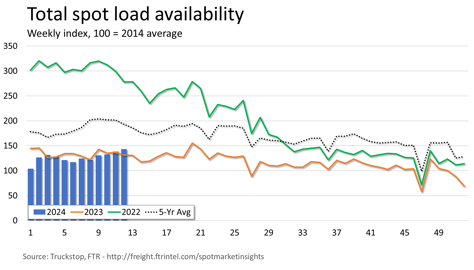

Total load activity increased 3.6% after rising 4.4% during the prior week. Total volume was up 9% from the same 2023 week – the strongest y/y comparison since February 2022 – but was nearly 26% below the five-year average. Truck postings increased 1.1%, and the total Market Demand Index – the ratio of loads to trucks – rose to its highest level since the first week of 2023. However, the flatbed MDI continued to increase while the MDIs for dry van and refrigerated eased.

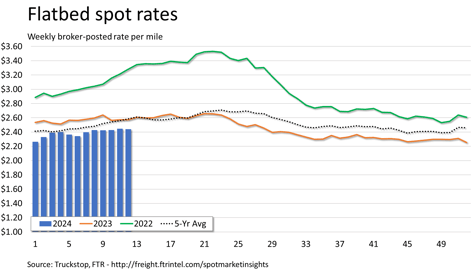

The total broker-posted rate increased six-tenths of a cent after rising 1.7 cents in the previous week. Rates were nearly 5% below the same 2023 week and close to 7% below the five-year average for the week. Even though flatbed spot rates eased slightly, they raised the total market rate because flatbed rates are so much higher than van rates and because flatbed volume rose while van load postings were down.

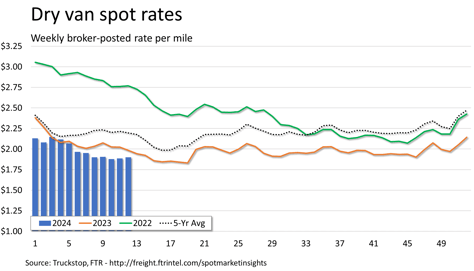

Dry van spot rates increased 1.3 cents, which is the largest weekly gain for that equipment type since the weather-related increase in week 3. Rates, which were up in consecutive weeks for the first time this year, were more than 4% below the same week last year and almost 14% below the five-year average for the week. Dry van loads decreased 5.9%. Volume was marginally higher than during the same 2023 week but was more than 31% below the five-year average for the week.

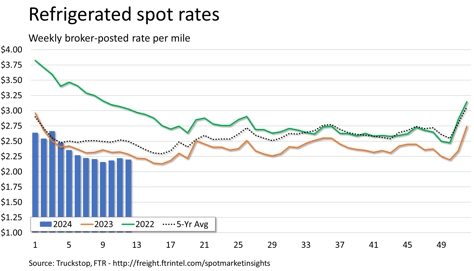

Refrigerated spot rates decreased more than 2 cents after rising about 4 cents during the prior week. Rates were about 4% below the same 2023 week and 12% below the five-year average for the week. The current week (week 13) is the week before Easter, which typically is a solid week for refrigerated spot volume and rates. Refrigerated loads declined 3.3%. Volume was nearly 6% above the same 2023 week – the first positive y/y comparison since week 4 – but 33% below the five-year average for the week.

Flatbed spot rates declined six-tenths of a cent after increasing 1.7 cents in the previous week. Rates were more than 5% below the same week last year and almost 6% below the five-year average for the week. Flatbed rates were about 24 cents higher than current refrigerated rates and about 54 cents above current dry van rates. Flatbed loads rose 10%. Volume was more than 15% higher than the same week last year – the strongest y/y comparison since February 2022 – but was more than 24% below the five-year average for the week.