Spot rates change little for the second straight week

The total broker-posted spot rate in the Truckstop system barely moved during the week ended March 8 (week 10) after declining less than a penny during the previous week. Dry van spot rates resumed their downward trend after a small uptick in the prior week while refrigerated spot rates increased for the first time since the weather-induced spike in mid-January. Flatbed rates rose by just enough to reverse the small decrease that had occurred the week before. Load postings increased slightly.

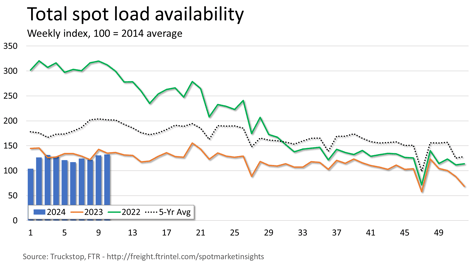

Total load activity increased 1.6% after rising more than 7% during the prior week. Total volume was less than 2% below the same 2023 week and more than 34% below the five-year average. Truck postings fell 7.7% for only the second decrease of the year and the largest since the final week of 2023. The total Market Demand Index – the ratio of loads to trucks – was the highest in seven weeks. Flatbed has consistently led other equipment types in MDI recently, rising to the highest level since July 2022 in the latest week.

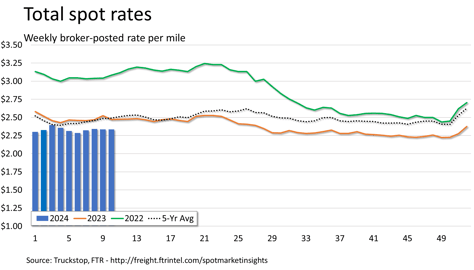

The total broker-posted rate ticked up two-tenths of a cent after slipping seven-tenths of a cent in the previous week. Rates were more than 5% below the same 2023 week and about 6% below the five-year average for the week. Aside from the weather-related distortions in weeks 3 and 4, total spot rates have not varied by more than 6 cents during 2024.

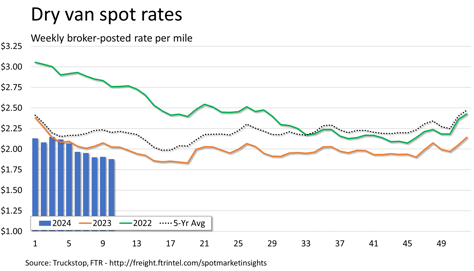

Dry van spot rates decreased nearly 3 cents after ticking up a half cent during the previous week. Rates, which have declined in eight of the past 10 weeks, were more than 7% below the same week last year and almost 15% below the five-year average for the week. Dry van rates are the lowest since the week before last May’s International Roadcheck inspection event and are less than 5 cents higher than they were in June 2020. Dry van loads eased 0.6%. Volume was 3.5% below the same week last year and more than 36% below the five-year average for the week.

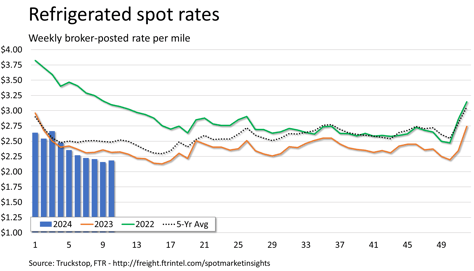

Refrigerated spot rates increased 2.5 cents after declining for six straight weeks. Rates were nearly 6% below the same 2023 week and about 12% below the five-year average for the week. Aside from the previous week, refrigerated rates are the lowest since April 2023 and are less than 7 cents higher than they were in June 2020. Refrigerated loads rose 3.9%. Volume was more than 7% below the same 2023 week and nearly 42% below the five-year average for the week.

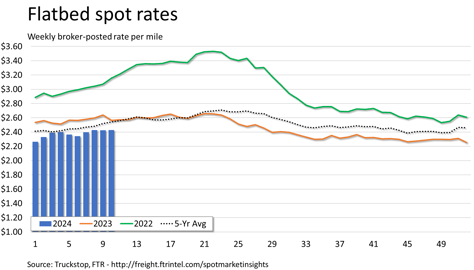

Flatbed spot rates edged up half a cent after easing by the same amount in the previous week. Rates were about 5% below the same week last year and more than 4% below the five-year average for the week. Although broker-posted flatbed spot rates were almost exactly where they were two weeks earlier, they technically were the highest since July of last year. Flatbed loads rose 3%. Volume is basically the same as it was during the same week last year but was more than 35% below the five-year average for the week.