Spot rates’ slide continues in the latest week

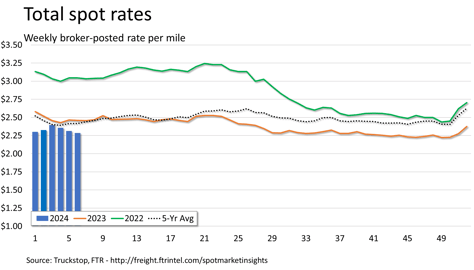

Total broker-posted spot rates in the Truckstop system declined for the third straight week during the week ended February 9 (week 6) as rates fell in all equipment types. Dry van saw the sharpest drop, producing the lowest weekly spot rate since the week before Thanksgiving. Refrigerated’s decrease was the smallest of the past three weeks but still substantial. Flatbed rates declined for a second straight week. The weather-related spike in week 3 may still be distorting weekly patterns, however.

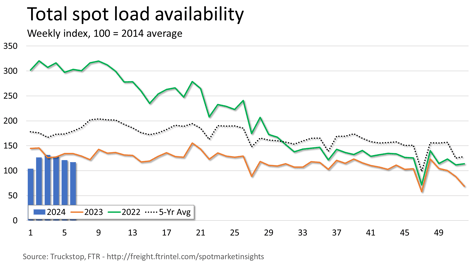

Total load activity declined 3.7% after decreasing nearly 6% during the previous week. Total volume was nearly 13% below the same 2023 week and almost 35% below the five-year average. Truck postings ticked up 0.2%, and the total Market Demand Index – the ratio of loads to trucks – declined to its lowest level since the final week of 2023.

The total broker-posted rate declined 3 cents after decreasing more than 4 cents in the prior week. Rates were about 7% below the same 2023 week and more than 5% below the five-year average. Even with the declines, total rates were less negative y/y than they were during any week between August 2022 and the third week of this year.

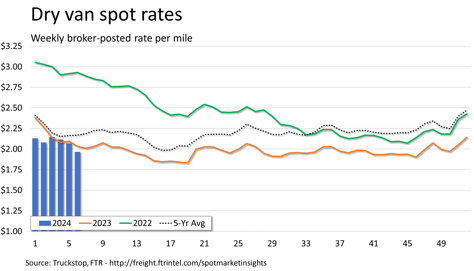

Dry van spot rates dropped just over 10 cents after falling nearly 5 cents during the previous week. Rates were more than 3% below the same week last year and more than 9% below the five-year average. Dry van loads fell 14.6% after declining nearly 11% during the prior week. Volume was more than 17% below the same 2023 week and nearly 38% below the five-year average for the week.

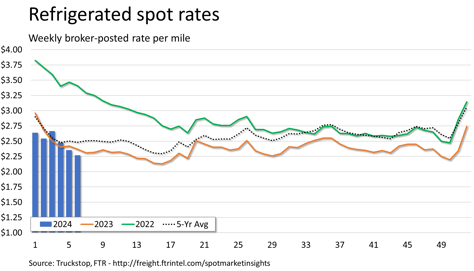

Refrigerated spot rates fell more than 8 cents after dropping more than 12 cents during the prior week. Rates, which were at their lowest level since mid-December, were about 4% below the same 2023 week and nearly 9% below the five-year average. Refrigerated loads fell 10.8% after declining by about the same degree during the previous week. Volume was about 13% below the same week last year and nearly 39% below the five-year average.

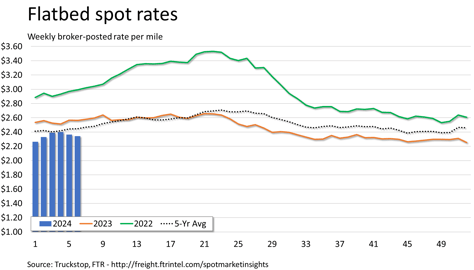

Flatbed spot rates declined more than 2 cents after decreasing 3.5 cents in the previous week. Rates, which had not fallen in consecutive weeks since November, were nearly 9% below the same week last year and about 4% below the five-year average. Flatbed loads rose 8.3% after easing 0.4% during the prior week. Volume was nearly 9% below the same 2023 week and almost 36% below the five-year average for the week.