Spot rates fall further in the latest week

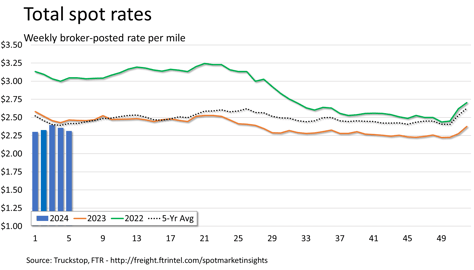

Broker-posted spot rates in the Truckstop system declined for all equipment types during the week ended February 2 (week 5) as dry van and refrigerated rates have fallen back to about where they were during the week before Christmas. Flatbed rates fell for the first time in five weeks. Even though total spot rates have fallen in three of the year’s five weeks, rates are still less negative y/y than they were during any week between mid-August 2022 and the third week of this year.

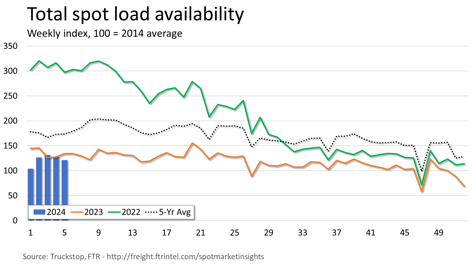

Total load activity declined 5.7% after easing more than 2% during the previous week. Total volume was down nearly 10% compared to the same 2023 week and about 30% below the five-year average. Truck postings increased 1.1%, and the total Market Demand Index – the ratio of loads to trucks – fell to its lowest level of the year.

The total broker-posted rate declined more than 4 cents after decreasing just under 4 cents in the prior week. Rates were about 6% below the same 2023 week and about 4% below the five-year average. Total rates have been basically steady in 2024 aside from the temporary boost due to winter weather.

Dry van spot rates were down nearly 5 cents after declining about 3 cents during the previous week. After being slightly higher y/y for two weeks, dry van rates were down more than 1% from the same 2023 week and close to 5% below the five-year average. Dry van loads declined 10.7% after holding steady during the prior week. Like rates, volume had been above prior-year levels in the two most recent weeks, but it was down nearly 9% compared to the same 2023 week. Volume was down about 25% from the five-year average for the week.

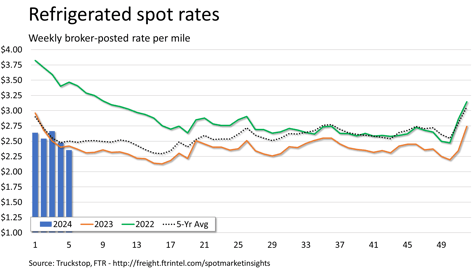

Refrigerated spot rates fell more than 12 cents after plunging nearly 19 cents during the prior week, which was the week following the major weather event. As was the case with dry van, refrigerated rates had been positive y/y for two weeks, but they were down nearly 3% in the latest week and 6% below the five-year average. Refrigerated loads fell 11.1% after dropping about 17% during the previous week. Volume had been sharply higher y/y in weeks 3 and 4, but in the latest week it was down about 12% from the same 2023 week and about 32% below the five-year average.

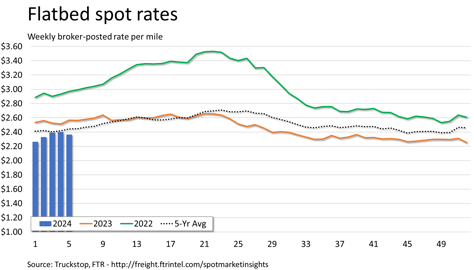

Flatbed spot rates declined 3.5 cents after rising for four straight weeks. Rates were nearly 8% below the same 2023 week and more than 3% below the five-year average. Flatbed loads eased 0.4% after ticking up the same percentage during the previous week. Volume was about 10% below the same 2023 week and more than 37% below the five-year average for the week.