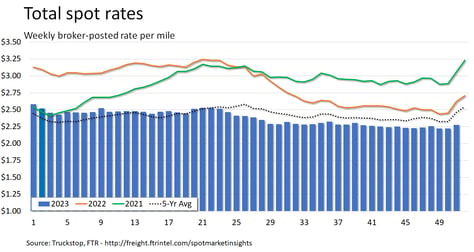

Total spot rates rise by the most since May

Broker-posted spot rates in the Truckstop system posted their strongest week-over-week increase since mid-May during the week ended December 22 (week 51), although the gain was weaker than typical for the next-to-last week of the year. Rates for refrigerated equipment posted their second strongest increase of 2023, but the dry van increase was slightly smaller than the one during Thanksgiving week and comparable to one the following week. Flatbed rates rose by the most since late September.

Total load activity fell 12.2% as an increase in refrigerated loads moderated declines for other equipment types. Total volume was down about 21% compared to the same 2022 week and about 23% compared to the five-year average. Truck postings decreased 8.2%, and the total Market Demand Index – the ratio of loads to trucks – declined. Truck postings typically fall by a greater extent during comparable weeks. Week 51 ended two days before Christmas eve, which likely was a factor in the relatively mild decline in capacity and relatively small rate increases compared to prior years.

The total broker-posted rate increased just over 5 cents after holding steady during the previous week. Rates were about 13% below the same 2022 week and more than 7% below the five-year average. Total market rates were at their highest level since early August. Spot rates were up for all equipment types, but the week-over-week gains were far smaller than they were during the same 2022 week.

Dry van spot rates increased 8 cents after declining more than 2 cents during the prior week. The increase was the smallest for a week 51 since 2018. One factor might have been a subdued capacity hit as dry van truck postings eased only 2.4%. Rates were about 13% below the same 2022 week and nearly 13% below the five-year average. Dry van loads fell 12.7%. Volume was almost 23% below the same 2022 week and nearly 22% below the five-year average for the week.

Refrigerated spot rates jumped 14.6 cents for the largest increase since the week of the International Roadcheck inspection event in May. However, the increase was much smaller than those seen during the same week in recent years; in 2020-2022, refrigerated rates rose by at least 35 cents during week 51. Those years also saw sharper drops in truck postings. Rates were about 18% below the same 2022 week and about 15% below the five-year average. Refrigerated loads increased 9.1%. Volume was nearly 36% below the same week last year and almost 34% below the five-year average for the week.

Flatbed spot rates increased 1.6 cents after easing four-tenths of a cent during the previous week. Increases during week 51 are typically much stronger. Flatbed rates, which were at their highest level since mid-October, were more than 12% below the same 2022 week and 2.5% below the five-year average. Flatbed loads fell 17.1%. Volume was about 9% below the same 2022 week and nearly 26% below the five-year average for the week.