Refrigerated spot rates rise sharply heading into Thanksgiving

Spot rates for refrigerated equipment reflected expected seasonal strength in the latest week, but dry van equipment is not yet showing any signs of typical holiday gains. Broker-posted spot rates in the Truckstop system during the week ended November 3 (week 44) rose for only the second time since the end of August as a sharp increase in refrigerated spot rates offset small declines in flatbed and dry van. All three segments saw stronger load postings, but refrigerated greatly outpaced the others.

Total load activity rose 8.2% after declining about 4% during the prior week. Volume was about 17% below the same 2022 week and about 24% below the five-year average for the week. Volume was up in all regions. Truck postings declined 3.1%, and the Market Demand Index – the ratio of loads to trucks – rose to its highest level in four weeks.

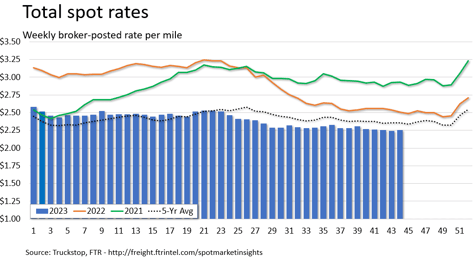

The total broker-posted rate increased just over 1 cent after easing by the same amount during the previous week. Rates were about 10% below the same 2022 week and about 4% below the five-year average. Total market rates are moving in line with seasonal expectations as flatbed rates are holding up better than expected while dry van rates are not yet showing seasonal gains.

Dry van spot rates eased seven-tenths of a cent after rising just over 1 cent during the previous week. Rates, which have declined in four of the past five weeks, were nearly 8% below the same week last year and nearly 10% below the five-year average. Dry van loads increased 9% and were up in all regions but just barely so on the West Coast. Volume was nearly 19% below the same 2022 week and 24% below the five-year average.

Refrigerated spot rates rose just over 11 cents for the largest increase since early August. Rates were nearly 7% below the same 2022 week and almost 5% below the five-year average. Both comparisons were the least negative since late August. Refrigerated loads jumped nearly 25%, and volume rose in all regions. Load volume was about 10% below the same week last year and about 22% below the five-year average for the week.

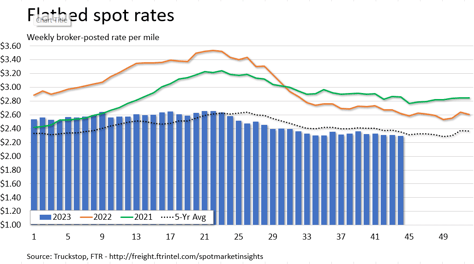

Flatbed spot rates declined just over 1 cent after ticking up four-tenths of a cent during the prior week. Rates were about 12% below the same 2022 week and about 2% below the five-year average. Flatbed loads increased 2.7% after falling more than 4% in the previous week. Loads were up in the South Central, Midwest, and Mountain Central regions but down elsewhere. Volume was more than 17% below the same 2022 week and about 31% below the five-year average for the week.