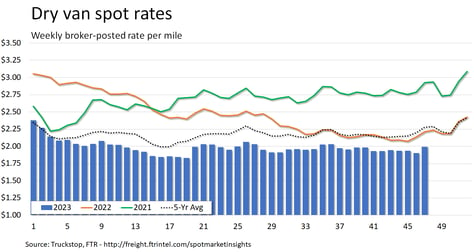

Dry van finally sees seasonal strength in spot rates

After seven straight weeks with only one week-over-week increase, dry van spot rates in the Truckstop system jumped by the most since May during the week ended November 24 (week 47). Broker-posted rates for dry van equipment invariably increase during Thanksgiving week, so the failure to do so might have signaled greater weakness. Refrigerated spot rates fell by about as much as dry van rates rose, and flatbed spot rates increased modestly. Refrigerated rates often decline during the holiday week.

Total load activity plunged 44.4% during the holiday week. Volume was almost 19% below the same 2022 week and nearly 39% below the five-year average for the week. Truck postings did not drop by nearly as much as load postings, falling 18.8%. The total Market Demand Index – the ratio of loads to trucks – fell to its lowest level since May 2020. The MDIs for dry van and flatbed were marginally higher than they were during Thanksgiving week last year; the refrigerated MDI was the lowest since April.

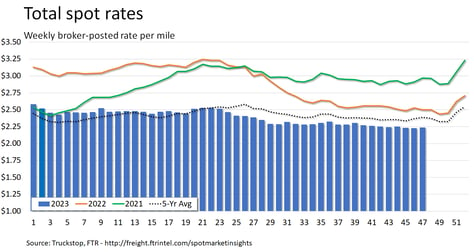

The total broker-posted rate increased just over 1 cent after easing six-tenths of a cent during the prior week. Rates were more than 10% below the same 2022 week and more than 6% below the five-year average. The comparison versus the five-year average was the weakest since late July. Total rates have been largely stable during November but have not shown the slight bump typically experienced during the month.

Dry van spot rates rose just over 9 cents for the largest gain since the spike of more than 16 cents during International Roadcheck week in May. The increase during Thanksgiving week was larger than last year’s gain, but double-digit increases are common. Rates were nearly 9% below the same week last year and 12.5% below the five-year average. Dry van loads fell 38.4% during the holiday week. Volume was nearly 17% below the same 2022 week and about 39% below the five-year average for the week.

Refrigerated spot rates fell more than 9 cents for the largest decrease since mid-September. Refrigerated rate decreases are not unusual during Thanksgiving week, but the scope was larger than usual. Refrigerated rates had been basically flat in week 46, which also was weaker than typical. Rates in week 47 were 12% below the same 2022 week and more than 11% below the five-year average. Refrigerated loads fell 46.1%. Volume was almost 27% below the same week last year and nearly 44% below the five-year average for the week.

Flatbed spot rates increased more than 1 cent for the largest gain since late September. Rate performance during Thanksgiving week has been less consistent for flatbed than for van equipment. Flatbed rates were not as strong week over week in 2021 and 2022, but they were stronger in 2018-2020. Rates were nearly 13% below the same 2022 week and 1.6% below the five-year average, which is the least negative comparison since early June. Flatbed loads dropped 49.3%. Volume was more than 10% below the same 2022 week and more than 42% below the five-year average for the week.