Spot rates lag seasonal expectations heading into Thanksgiving

Total broker-posted spot rates in the Truckstop system almost always rise during the week before Thanksgiving, but that did not happen during the week ended November 17 (week 46). Spot rates barely changed for refrigerated and flatbed, and dry van spot rates declined modestly. All three equipment types usually see rate increases during the week before Thanksgiving. Capacity shortfalls during Thanksgiving week usually mean higher dry van spot rates, but last week’s weakness creates uncertainty.

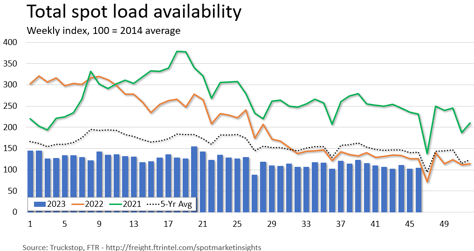

Total load activity edged up 1.5% after falling nearly 8% during the previous week. Volume was about 17% below the same 2022 week and around 26% below the five-year average for the week. Volume was down in the Mountain Central and South Central regions but up elsewhere. Truck postings increased 4.8%, and the Market Demand Index – the ratio of loads to trucks – declined to the lowest level since August.

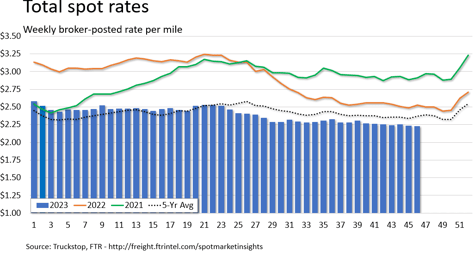

The total broker-posted rate eased six-tenths of a cent after declining just over 2 cents during the prior week. Rates were about 12% below the same 2022 week and about 6% below the five-year average. The comparison versus the five-year average was the weakest since late July. Total rates had been moving generally according to seasonal expectations, but the latest week clearly was weaker than what seasonality would dictate.

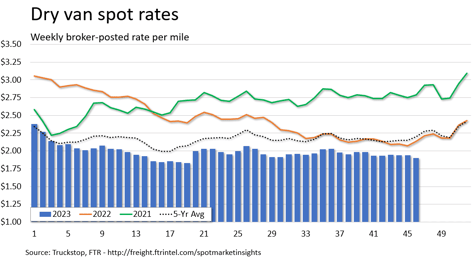

Dry van spot rates fell 3.5 cents after holding steady during the previous week. Rates were 11% below the same week last year and 13.5% below the five-year average. The comparison with the five-year average was the weakest since the spring of 2020. Dry van rates are only about 7 cents higher than the recent bottom during the week before the International Roadcheck inspection event in May. Dry van loads increased 4.6% after falling nearly 9% in the prior week. Loads were down on the West Coast and barely changed in the Northeast but were up elsewhere. Volume was about 19% below the same 2022 week and 28% below the five-year average.

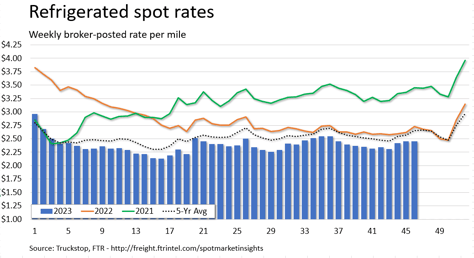

Refrigerated spot rates barely changed, ticking up just one-tenth of a cent after rising about 3 cents during the prior week. Refrigerated rates typically increase significantly during the week before Thanksgiving. Rates were about 10% below the same 2022 week and almost 8% below the five-year average. Refrigerated loads increased 1.4% after edging up about half a percent during the previous week. Loads rose strongly in the Southeast and were up on the West Coast and in the South Central region but were down elsewhere. Load volume was almost 21% below the same week last year and nearly 28% below the five-year average for the week.

Flatbed spot rates increased seven-tenths of a cent after falling more than 3 cents during the previous week. Rates were nearly 14% below the same 2022 week and more than 2% below the five-year average. Flatbed loads eased 1.2% after falling more than 11% during the previous week. Loads were down sharply in the Mountain Central and South Central regions and slightly in the Southeast but were up elsewhere. Volume was nearly 14% below the same 2022 week and about 32% below the five-year average for the week.