Spot rates continue to track mostly with seasonal expectations

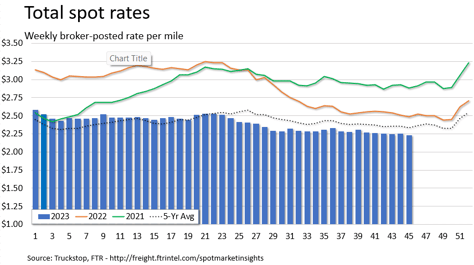

After rising for the first time in five weeks, total broker-posted spot rates in the Truckstop system returned to their slight downward trend during the week ended November 10 (week 45). Spot rates for refrigerated equipment rose for a second straight week for the first time since early September. Dry van spot rates were unchanged while flatbed rates declined by the most in five weeks. Spot rates are down year over year in all three segments, but they are generally following seasonal expectations.

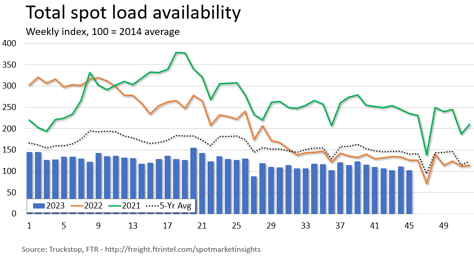

Total load activity fell 7.8% after rising a bit more than 8% during the previous week. Volume was nearly 19% below the same 2022 week and about 27% below the five-year average for the week. Volume was up in the Mountain Central region but down elsewhere. Truck postings were basically unchanged week over week, and the Market Demand Index – the ratio of loads to trucks – declined but remained higher than it was two weeks earlier.

The total broker-posted rate declined just over 2 cents after rising just over 1 cent during the prior week. Rates were about 10% below the same 2022 week – the same as the prior week’s comparison – and more than 4% below the five-year average, which is close to the week 44 comparison. Despite some differences in equipment types, rates overall are maintaining the very gradual easing that is typical between Labor Day and Thanksgiving.

Dry van spot rates were flat week over week after easing less than 1 cent during the previous week. Rates were nearly 7% below the same week last year and about 10% below the five-year average. Dry van rates often do not begin to show seasonal strength until the week before Thanksgiving, so the segment’s lack of rate growth does not necessarily indicate any further weakening of the market. Dry van loads fell 8.6% after rising 9% in the prior week. Loads were up in the Mountain Central region but down elsewhere. Volume was nearly 22% below the same 2022 week and almost 29% below the five-year average.

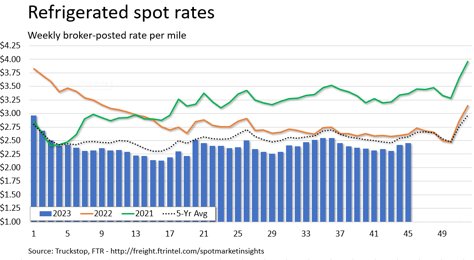

Refrigerated spot rates increased just under 3 cents after soaring more than 11 cents in the prior week. Rates were nearly 7% below the same 2022 week and almost 5% below the five-year average. Both comparisons were essentially the same as they were in week 44, suggesting that refrigerated rates are tracking closely with seasonal expectations. Refrigerated loads eased 0.4% after surging nearly 25% during the previous week. Loads were up in the Mountain Central region and, slightly, on the West Coast but down elsewhere. Load volume was about 20% below the same week last year and 26% below the five-year average for the week.

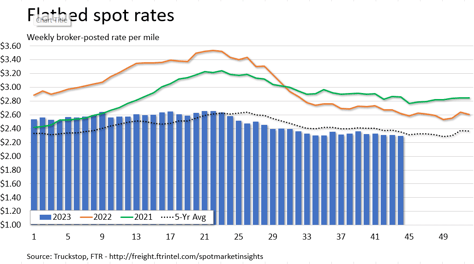

Flatbed spot rates fell more than 3 cents for the largest drop since early October. The decrease was slightly more in keeping with seasonal expectations than the recent stability that has marked flatbed rates. Rates were more than 12% below the same 2022 week and about 2% below the five-year average. As with refrigerated, those comparisons barely changed versus week 44. Flatbed loads fell 11.3% after rising nearly 3% during the previous week. Loads were down in all regions. Volume was about 14% below the same 2022 week and 33% below the five-year average for the week.