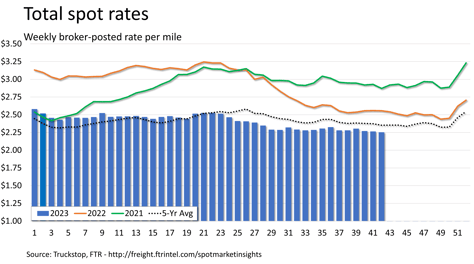

Total spot rates decrease slightly in the latest week

Broker-posted spot rates in the Truckstop system were down for the third straight week during the week ended October 20 (week 42). After six straight weeks of decreases, refrigerated spot rates rose modestly. However, flatbed spot rates declined, and dry van spot rates were essentially unchanged week over week. Total spot rates are moving in line with seasonal expectations slightly below the five-year average. Spot volume was down as decreases in flatbed and dry van offset an increase in refrigerated.

Total load activity declined 2.9% after falling nearly 5% during the prior week. Volume was nearly 19% below the same 2022 week and more than 26% below the five-year average for the week. Truck postings declined 1.6%, and the Market Demand Index – the ratio of loads to trucks – eased slightly to its lowest level since mid-August.

The total broker-posted rate eased 1 cent after being down a fraction of a cent during the previous week. Rates were nearly 12% below the same 2022 week and more than 4% below the five-year average. Total market rates have decreased in five of the past six weeks but are moving mostly as expected during the period between Labor Day and Thanksgiving.

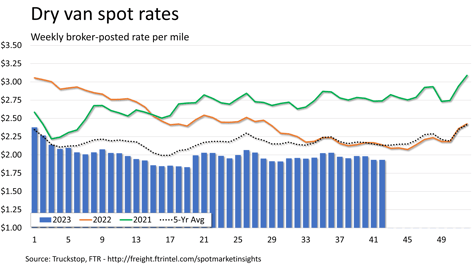

Dry van spot rates were unchanged after falling about 5 cents during the prior week. Rates were almost 10% below the same week last year and more than 9% below the five-year average. Dry van spot rates are still about 10 cents higher than during the recent low, which was the week before the International Roadcheck inspection event. Dry van loads eased 1% after falling more than 5% in the previous week. Volume was almost 21% below the same 2022 week and almost 26% below the five-year average.

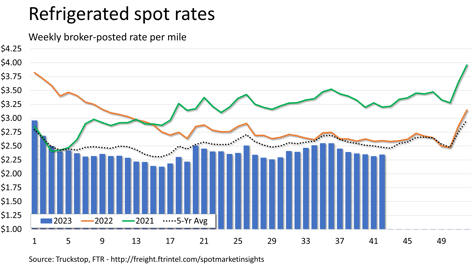

Refrigerated spot rates increased nearly 3 cents after falling slightly more than 3 cents during the previous week. Rates were nearly 10% below the same 2022 week and about 5% below the five-year average. Refrigerated rates are still about 22 cents higher than the recent low in April. Refrigerated loads increased 6.9% after falling nearly 6% during the prior week. Volume was nearly 19% below the same week last year and about 25% below the five-year average for the week.

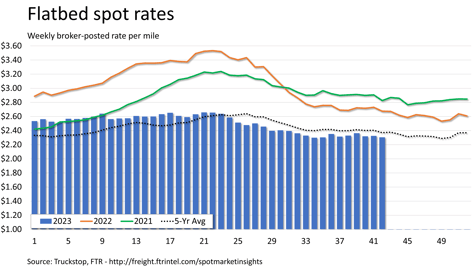

Flatbed spot rates fell 2 cents after increasing a fraction of a cent during the prior week. Rates were nearly 14% below the same 2022 week and nearly 3% below the five-year average. Flatbed loads fell 5.7% after falling by about the same degree in the previous week. Volume was nearly 18% below the same 2022 week and more than 33% below the five-year average for the week.