Total spot rates increase modestly in the latest week

Total broker-posted rates in the Truckstop system moved higher during the week ended September 29 (week 39) as gains for other equipment types offset a decline in refrigerated spot rates. Flatbed spot rates have risen in four of the past five weeks while dry van spot rates increased after two down weeks. Refrigerated rates were down for the fourth straight week and were the lowest since late July. Recent week-to-week moves have been at least as strong as seasonal expectations for all equipment types.

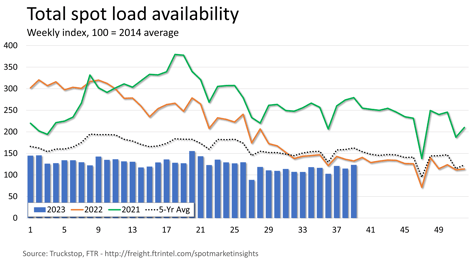

Total load activity rose 7.6% after declining about 5% during the prior week. Volume was nearly 7% below the same 2022 week and about 24% below the five-year average for the week. The y/y comparison was the least negative since July 2022, but that one week was an outlier. Volume has not been consistently stronger than the prior year since March 2022. Spot volume rose in all regions, led by the West Coast. Truck postings declined 1.6%, and the Market Demand Index – the ratio of loads to trucks – rose to its highest level since early June.

Total load activity rose 7.6% after declining about 5% during the prior week. Volume was nearly 7% below the same 2022 week and about 24% below the five-year average for the week. The y/y comparison was the least negative since July 2022, but that one week was an outlier. Volume has not been consistently stronger than the prior year since March 2022. Spot volume rose in all regions, led by the West Coast. Truck postings declined 1.6%, and the Market Demand Index – the ratio of loads to trucks – rose to its highest level since early June.

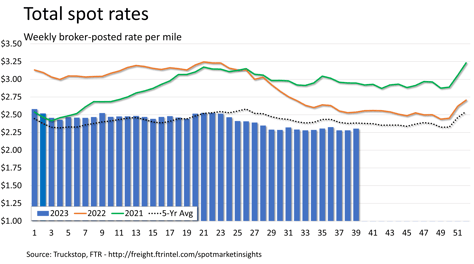

The total broker-posted rate increased about 2.5 cents after holding steady during the previous week. Rates were about 9% below the same 2022 week – the least negative y/y comparison since August 2022 – and more than 3% below the five-year average. The deficit versus the five-year average is the lowest since June.

The total broker-posted rate increased about 2.5 cents after holding steady during the previous week. Rates were about 9% below the same 2022 week – the least negative y/y comparison since August 2022 – and more than 3% below the five-year average. The deficit versus the five-year average is the lowest since June.

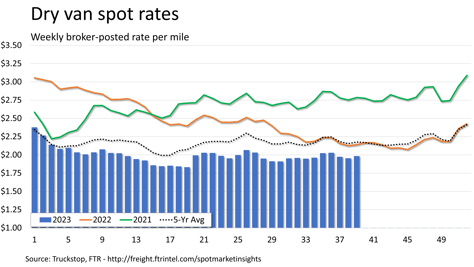

Dry van spot rates increased almost 3 cents after declining 2 cents during the prior week. Rates were more than 7% below both the same week last year and nearly 9% below the five-year average. Dry van loads increased 8.4% after declining 4.8% in the previous week. Loads were down in the Northeast but up in all other regions. Volume was more than 12% below the same 2022 week and more than 23% below the five-year average.

Dry van spot rates increased almost 3 cents after declining 2 cents during the prior week. Rates were more than 7% below both the same week last year and nearly 9% below the five-year average. Dry van loads increased 8.4% after declining 4.8% in the previous week. Loads were down in the Northeast but up in all other regions. Volume was more than 12% below the same 2022 week and more than 23% below the five-year average.

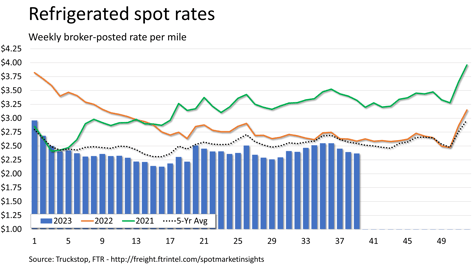

Refrigerated spot rates decreased 2.5 cents after falling more than 6 cents during the previous week. Rates were nearly 9% below the same 2022 week and about 7% below the five-year average. Refrigerated loads ticked up 1.4% after falling 11.5% during the prior week. Loads were up in the Southeast, West Coast, and South Central regions but down elsewhere. Volume was 21% below the same week last year and almost 29% below the five-year average for the week.

Refrigerated spot rates decreased 2.5 cents after falling more than 6 cents during the previous week. Rates were nearly 9% below the same 2022 week and about 7% below the five-year average. Refrigerated loads ticked up 1.4% after falling 11.5% during the prior week. Loads were up in the Southeast, West Coast, and South Central regions but down elsewhere. Volume was 21% below the same week last year and almost 29% below the five-year average for the week.

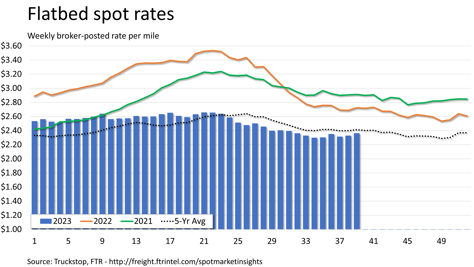

Flatbed spot rates increased 3.4 cents after rising 1.5 cents during the prior week. Rates were more than 13% below the same 2022 week and 2% below the five-year average. Flatbed loads increased 7.3% after declining 4.7% in the previous week. Loads were up in all regions. Volume was 0.4% higher than the same 2022 week for the first positive y/y comparison since March 2022. Volume was nearly 32% below the five-year average for the week.