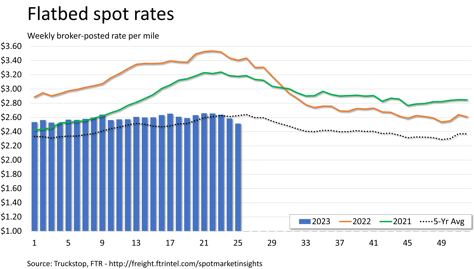

Van spot rates rise as flatbed rates fall sharply

Broker-posted dry van and refrigerated spot rates in the Truckstop system saw modest gains during the week ended June 23 (week 25), but flatbed spot rates fell sharply for the second straight week. The drop in flatbed spot rates was the largest since March. Dry van saw a larger increase than did refrigerated, but in both cases the gains were the largest since the surge in mid-May due to the International Roadcheck event. The van segments saw healthy volume increases while flatbed loads fell.

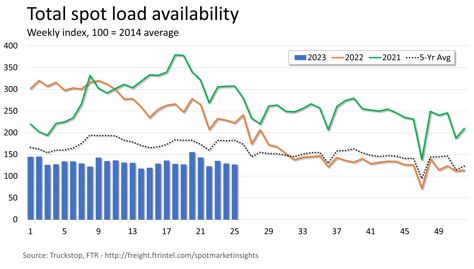

Total load activity fell 1.8% due solely to flatbed. Volume was about 43% below the same week last year and nearly 31% below the five-year average. Load activity was up on the West Coast and in the Mountain Central region, but regional volumes varied greatly by equipment type. Truck postings barely changed, ticking up just 0.1%, and the Market Demand Index – the ratio of loads to trucks – eased to its lowest level since the week before Roadcheck.

Total load activity fell 1.8% due solely to flatbed. Volume was about 43% below the same week last year and nearly 31% below the five-year average. Load activity was up on the West Coast and in the Mountain Central region, but regional volumes varied greatly by equipment type. Truck postings barely changed, ticking up just 0.1%, and the Market Demand Index – the ratio of loads to trucks – eased to its lowest level since the week before Roadcheck.

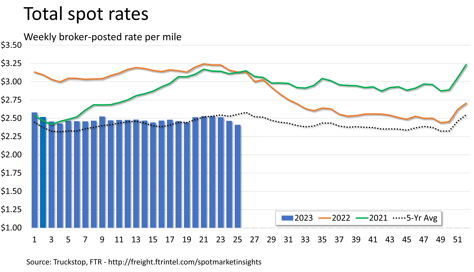

The total broker-posted rate fell just over 5 cents after falling exactly 5 cents during the previous week. The total market rate was 23% below the same 2022 week and 5.5% below the five-year average. Total rates typically rise during week 25 heading into the mid-year peak, but sharply weaker flatbed rates thwarted that expected move. The current week – week 26 – typically represents the peak of van spot rates each year except for the December holiday period.

The total broker-posted rate fell just over 5 cents after falling exactly 5 cents during the previous week. The total market rate was 23% below the same 2022 week and 5.5% below the five-year average. Total rates typically rise during week 25 heading into the mid-year peak, but sharply weaker flatbed rates thwarted that expected move. The current week – week 26 – typically represents the peak of van spot rates each year except for the December holiday period.

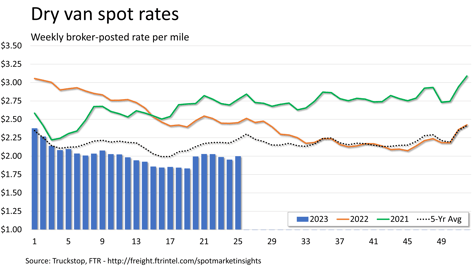

Dry van spot rates rose nearly 5 cents after declining 3.5 cents during the prior week. Rates were nearly 19% below the same 2022 week and more than 10% below the five-year average. Dry van rates traditionally rise significantly during the current week. Dry van loads increased 11.2%, which is the strongest gain since Roadcheck week. Volume was more than 34% below the same week last year and nearly 25% below the five-year average for the week. Loads were up in all regions except for the South Central region.

Dry van spot rates rose nearly 5 cents after declining 3.5 cents during the prior week. Rates were nearly 19% below the same 2022 week and more than 10% below the five-year average. Dry van rates traditionally rise significantly during the current week. Dry van loads increased 11.2%, which is the strongest gain since Roadcheck week. Volume was more than 34% below the same week last year and nearly 25% below the five-year average for the week. Loads were up in all regions except for the South Central region.

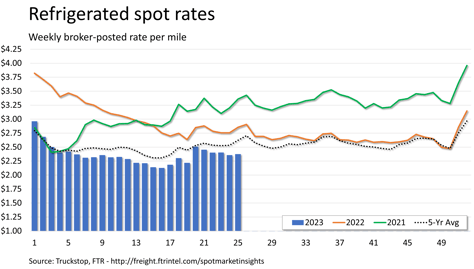

Refrigerated spot rates increased about 2 cents after falling nearly 5 cents in the previous week. Rates were almost 17% below the same 2022 week and more than 9% below the five-year average for the week. As with dry van, refrigerated rates almost always rise significantly during the current week of the year. Refrigerated loads jumped 18.4% – the strongest increase since Roadcheck week. Volume was nearly 45% below the same week last year and about 28% below the five-year average for the week. Loads were down on the West Coast but up in all other regions.

Refrigerated spot rates increased about 2 cents after falling nearly 5 cents in the previous week. Rates were almost 17% below the same 2022 week and more than 9% below the five-year average for the week. As with dry van, refrigerated rates almost always rise significantly during the current week of the year. Refrigerated loads jumped 18.4% – the strongest increase since Roadcheck week. Volume was nearly 45% below the same week last year and about 28% below the five-year average for the week. Loads were down on the West Coast but up in all other regions.

Flatbed spot rates fell more than 7 cents after dropping more than 5 cents in the prior week. The decrease was the segment’s largest since March. Rates were about 26% below the same 2022 week and more than 4% below the five-year average for the week. Flatbed loads fell 13.8%, which is the largest weekly decrease this year. Volume was nearly 50% below the same week last year and about 39% below the five-year average for the week. Loads were up on the West Coast but down in all other regions.