Van segment spot rates surge during International Roadcheck Week

As expected, the three-day period of increased roadside inspections known as International Roadcheck resulted in sharp increases in spot rates during the week ended May 19 (week 20). Broker-posted rates in the Truckstop system rose by the most since the December holidays for both dry van and refrigerated equipment. Flatbed rates also rose significantly, although that segment had seen a larger increase twice this year. Total market load activity rose by the most since the first week of this year.

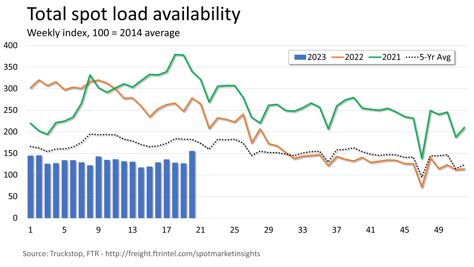

Total volume jumped 22.4% as Roadcheck disrupted capacity in the broader truck freight market. Volume was more than 44% below the same week last year and nearly 15% below the five-year average. The comparison with the five-year average is the strongest since early this year, but it is an outlier as Roadcheck has occurred during the same week of the year only once – in 2022 – over the past five years. Load activity rose in all regions. Truck postings fell 6.1%, and the Market Demand Index – the ratio of loads to trucks – jumped to its highest level since the first week of this year.

Total volume jumped 22.4% as Roadcheck disrupted capacity in the broader truck freight market. Volume was more than 44% below the same week last year and nearly 15% below the five-year average. The comparison with the five-year average is the strongest since early this year, but it is an outlier as Roadcheck has occurred during the same week of the year only once – in 2022 – over the past five years. Load activity rose in all regions. Truck postings fell 6.1%, and the Market Demand Index – the ratio of loads to trucks – jumped to its highest level since the first week of this year.

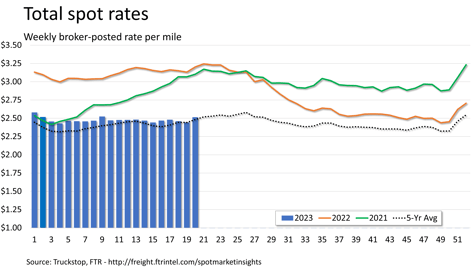

The total broker-posted rate rose just over 7 cents, which is the strongest gain since the final week of 2022. The total market rate was nearly 22% below the same 2022 week but more than 1% above the five-year average. The total market rate increase was on par with the one that occurred during last year’s International Roadcheck. Rates also rose notably during the week following Roadcheck last year.

The total broker-posted rate rose just over 7 cents, which is the strongest gain since the final week of 2022. The total market rate was nearly 22% below the same 2022 week but more than 1% above the five-year average. The total market rate increase was on par with the one that occurred during last year’s International Roadcheck. Rates also rose notably during the week following Roadcheck last year.

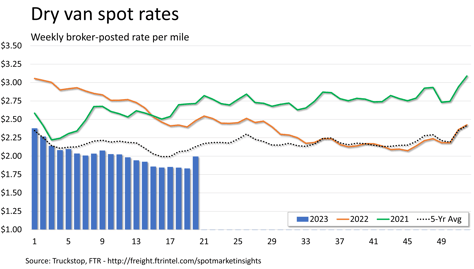

Dry van spot rates jumped more than 16 cents, slightly more than offsetting the net loss seen during decreases over six of the past seven weeks. The increase was much sharper than the nearly 9-cent gain during last year’s Roadcheck and marginally larger than the increase during the 2021 Roadcheck, which occurred during week 18. Rates were nearly 20% below the same 2022 week and more than 6% below the five-year average for the week. Dry van loads jumped nearly 28%. Volume was more than 39% below the same week last year and nearly 9% below the five-year average for the week.

Dry van spot rates jumped more than 16 cents, slightly more than offsetting the net loss seen during decreases over six of the past seven weeks. The increase was much sharper than the nearly 9-cent gain during last year’s Roadcheck and marginally larger than the increase during the 2021 Roadcheck, which occurred during week 18. Rates were nearly 20% below the same 2022 week and more than 6% below the five-year average for the week. Dry van loads jumped nearly 28%. Volume was more than 39% below the same week last year and nearly 9% below the five-year average for the week.

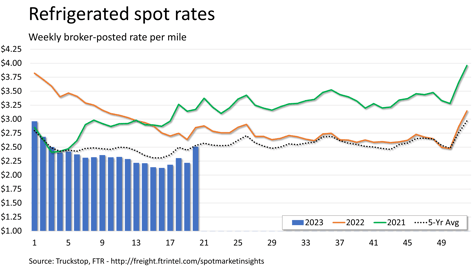

Refrigerated spot rates surged 29 cents to their highest level since the second week of this year. Rates had risen nearly 22 cents and about 30 cents during the 2022 and 2021 Roadcheck weeks, respectively. Refrigerated rates were 12% below the same 2022 week and just under 1% below the five-year average for the week. Refrigerated loads spiked 37% to their highest level since the second week of this year. Volume was 45% below the same week last year and about 6% below the five-year average for the week.

Refrigerated spot rates surged 29 cents to their highest level since the second week of this year. Rates had risen nearly 22 cents and about 30 cents during the 2022 and 2021 Roadcheck weeks, respectively. Refrigerated rates were 12% below the same 2022 week and just under 1% below the five-year average for the week. Refrigerated loads spiked 37% to their highest level since the second week of this year. Volume was 45% below the same week last year and about 6% below the five-year average for the week.

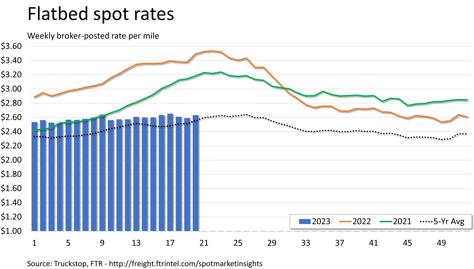

Flatbed spot rates increased 4 cents, which is a notable gain for that segment under normal circumstances. However, flatbed rates jumped about 12 cents during Roadcheck week last year and rose more than 6 cents during the 2021 Roadcheck week. Rates were almost 25% below the same 2022 week but still 3% above the five-year average for the week. Flatbed loads rose 17.5%. Volume was nearly 50% below the same week last year and 24% below the five-year average for the week.