Refrigerated spot rates jump again in the latest week

Following their strongest gain of 2023 so far, broker-posted spot rates for refrigerated equipment in the Truckstop system saw an even larger increase during the week ended May 5 (week 18). Dry van spot rates eased slightly while flatbed rates fell by the most since early March. The spot market has one more week of “normal” operations before the Commercial Vehicle Safety Alliance’s International Roadcheck event on May 16-18 presumably will yield sharp rate increases due to a disruption in capacity.

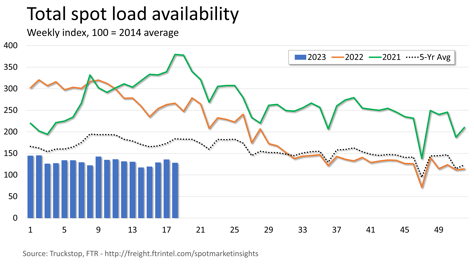

Total load activity fell 5.7% after three straight weekly gains. Volume was almost 52% below the same week last year and more than 30% below the five-year average. Loads were up on the West Coast but down in all other regions. Truck postings eased 0.5%, and the Market Demand Index – the ratio of loads to trucks – declined.

Total load activity fell 5.7% after three straight weekly gains. Volume was almost 52% below the same week last year and more than 30% below the five-year average. Loads were up on the West Coast but down in all other regions. Truck postings eased 0.5%, and the Market Demand Index – the ratio of loads to trucks – declined.

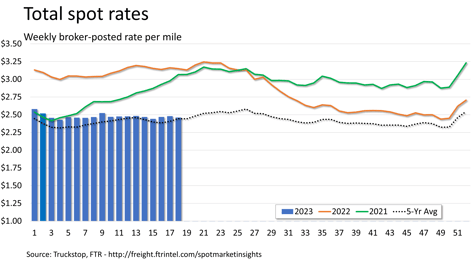

The total broker-posted rate fell just over 2 cents. The total market rate was about 22% below the same 2022 week but 0.6% above the five-year average. Rates could be in danger of slipping below the five-year average in the current week, but even if that happens the Roadcheck inspection event, which has moved around on the calendar in recent years, probably will push them back above average.

The total broker-posted rate fell just over 2 cents. The total market rate was about 22% below the same 2022 week but 0.6% above the five-year average. Rates could be in danger of slipping below the five-year average in the current week, but even if that happens the Roadcheck inspection event, which has moved around on the calendar in recent years, probably will push them back above average.

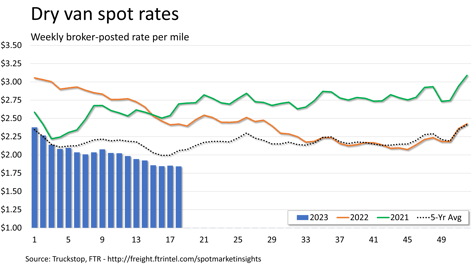

Dry van spot rates declined 1 cent, slightly more than offsetting the gain of seven-tenths of a cent in the prior week. Rates were about 24% below the same 2022 week and nearly 11% below the five-year average for the week. Dry van loads fell more than 7% after rising nearly 9% in the previous week. Volume was 49% below the same week last year and about 28% below the five-year average for the week. Volume ticked up slightly on the West Coast but otherwise was down in all regions.

Dry van spot rates declined 1 cent, slightly more than offsetting the gain of seven-tenths of a cent in the prior week. Rates were about 24% below the same 2022 week and nearly 11% below the five-year average for the week. Dry van loads fell more than 7% after rising nearly 9% in the previous week. Volume was 49% below the same week last year and about 28% below the five-year average for the week. Volume ticked up slightly on the West Coast but otherwise was down in all regions.

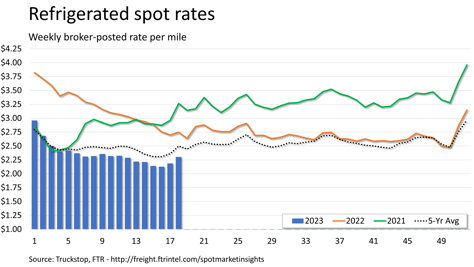

Refrigerated spot rates jumped nearly 12 cents, more than doubling the increase during the previous week. Rates were about 16% below the same 2022 week and nearly 8% below the five-year average for the week. Refrigerated loads rose about 8% following the gain of more than 10% in the prior week. Volume was more than 48% below the same week last year and nearly 27% below the five-year average for the week. Load activity was up in the Southeast and on the West Coast but down in all other regions.

Refrigerated spot rates jumped nearly 12 cents, more than doubling the increase during the previous week. Rates were about 16% below the same 2022 week and nearly 8% below the five-year average for the week. Refrigerated loads rose about 8% following the gain of more than 10% in the prior week. Volume was more than 48% below the same week last year and nearly 27% below the five-year average for the week. Load activity was up in the Southeast and on the West Coast but down in all other regions.

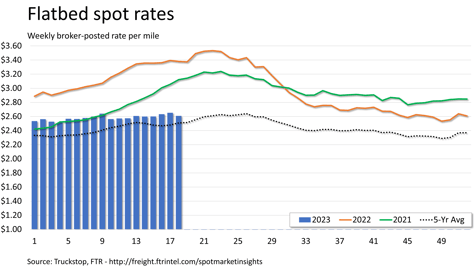

Flatbed spot rates fell more than 4 cents for the largest drop since week 10. Rates were nearly 23% below the same 2022 week but still 4% above the five-year average for the week. Flatbed loads fell nearly 8%. Volume was almost 58% below the same week last year and almost 37% below the five-year average for the week. Load activity was up slightly on the West Coast but down in all other regions.