Van spot rates ease again in the latest week

Dry van and refrigerated continued to see spot rate softness in the latest week, but rates could be close to bottoming out. Total market broker-posted spot rates in the Truckstop system increased during the week ended April 21 (week 16) on the strength of the flatbed segment. Dry van and refrigerated each saw rates ease slightly after the prior week had produced the largest rate drops since January for both. Based on seasonal expectations, van rates might begin firming within a couple of weeks.

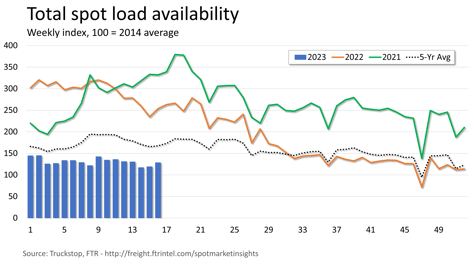

Total load activity rose 7.9%, which is the largest weekly gain in seven weeks. Volume was about 49% below the same week last year and about 23% below the five-year average. Loads were up week-over-week in the three largest regions for volume – South Central, Southeast, and Midwest. Truck postings increased 3%, and the Market Demand Index – the ratio of loads to trucks – rebounded nearly to the level posted two weeks earlier.

Total load activity rose 7.9%, which is the largest weekly gain in seven weeks. Volume was about 49% below the same week last year and about 23% below the five-year average. Loads were up week-over-week in the three largest regions for volume – South Central, Southeast, and Midwest. Truck postings increased 3%, and the Market Demand Index – the ratio of loads to trucks – rebounded nearly to the level posted two weeks earlier.

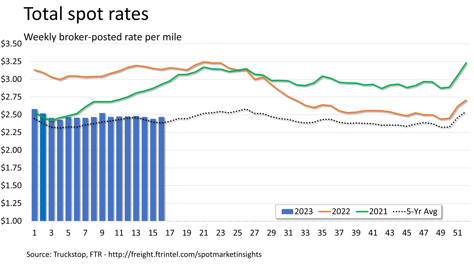

The total broker-posted rate rose 2.6 cents – precisely reversing the previous week’s decline. Flatbed’s rate strength more than offset the small decreases in van rates. The total market rate was more than 21% below the same 2022 week but 3.5% above the five-year average.

The total broker-posted rate rose 2.6 cents – precisely reversing the previous week’s decline. Flatbed’s rate strength more than offset the small decreases in van rates. The total market rate was more than 21% below the same 2022 week but 3.5% above the five-year average.

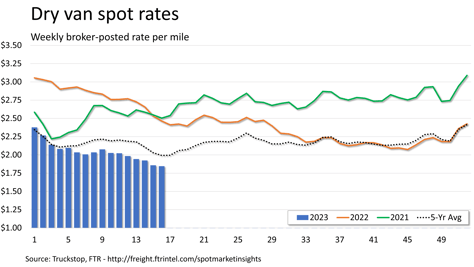

Dry van spot rates declined slightly more than 1 cent. Rates were about 25% below the same 2022 week and more than 7% below the five-year average for the week. Rates have decreased about 23 cents over seven straight weeks of declines. Dry van loads rose more than 5%. Volume was more than 45% below the same week last year and about 14% below the five-year average for the week. Volume was down week-over-week in the South Central and Mountain Central regions but up elsewhere.

Dry van spot rates declined slightly more than 1 cent. Rates were about 25% below the same 2022 week and more than 7% below the five-year average for the week. Rates have decreased about 23 cents over seven straight weeks of declines. Dry van loads rose more than 5%. Volume was more than 45% below the same week last year and about 14% below the five-year average for the week. Volume was down week-over-week in the South Central and Mountain Central regions but up elsewhere.

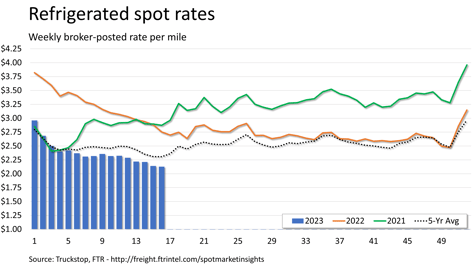

Refrigerated spot rates decreased just over 1 cent. Rates were almost 23% below the same 2022 week and nearly 8% below the five-year average for the week. Refrigerated rates have declined nearly 20 cents over the past five weeks. Refrigerated loads increased more than 4%. Volume was almost 53% below the same week last year and more than 26% below the five-year average for the week. Load activity was down marginally on the West Coast and in the South Central region, but it was up elsewhere.

Refrigerated spot rates decreased just over 1 cent. Rates were almost 23% below the same 2022 week and nearly 8% below the five-year average for the week. Refrigerated rates have declined nearly 20 cents over the past five weeks. Refrigerated loads increased more than 4%. Volume was almost 53% below the same week last year and more than 26% below the five-year average for the week. Load activity was down marginally on the West Coast and in the South Central region, but it was up elsewhere.

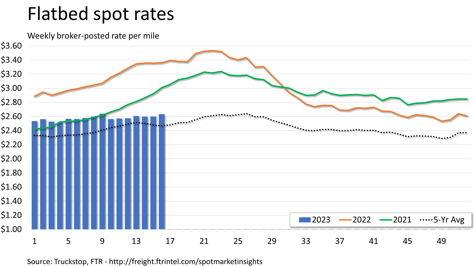

Flatbed spot rates rose more than 3 cents after barely moving in the prior week. Rates were nearly 22% below the same 2022 week but nearly 7% above the five-year average for the week. Flatbed loads rose more than 10%. Volume was 54% below the same week last year and nearly 31% below the five-year average for the week. Load activity was up in the Midwest, Southeast, and South Central regions.