Van spot rates fall by the most since January

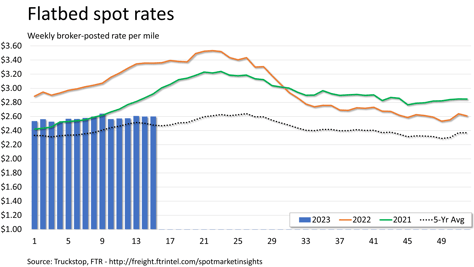

Broker-posted spot rates for dry van and refrigerated freight in the Truckstop system saw their largest week-over-week decreases since January during the week ended April 14 (week 15). Dry van rates have retreated for six straight weeks and have declined in 12 of 15 weeks this year. Refrigerated rates were down for the fourth consecutive week and have fallen in all but four weeks this year. Flatbed rates essentially held steady during the week, eking out a marginal gain over the prior week.

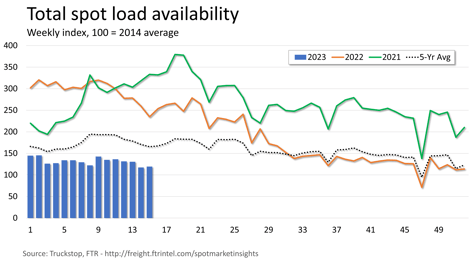

Total load activity rose 1.8% after falling about 10% in the prior week. Volume was about 49% below the same week last year and nearly 28% below the five-year average. Loads were up in the Northeast and Southeast but down elsewhere. Truck postings rose by nearly 7%. The Market Demand Index – the ratio of loads to trucks – fell to its lowest level in eight weeks.

Total load activity rose 1.8% after falling about 10% in the prior week. Volume was about 49% below the same week last year and nearly 28% below the five-year average. Loads were up in the Northeast and Southeast but down elsewhere. Truck postings rose by nearly 7%. The Market Demand Index – the ratio of loads to trucks – fell to its lowest level in eight weeks.

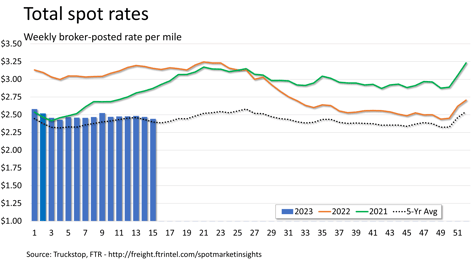

The total broker-posted rate fell 2.6 cents as stable flatbed rates offset much of the weakness in the van segments. The total market rate was about 23% below the same 2022 week but about 2% above the five-year average. If rates continue to track with the five-year average, they will begin to firm within a couple of weeks and peak around mid-year.

The total broker-posted rate fell 2.6 cents as stable flatbed rates offset much of the weakness in the van segments. The total market rate was about 23% below the same 2022 week but about 2% above the five-year average. If rates continue to track with the five-year average, they will begin to firm within a couple of weeks and peak around mid-year.

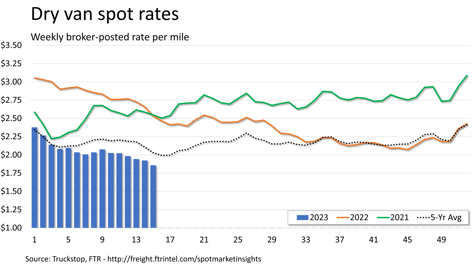

Dry van spot rates fell 6.5 cents. Rates were nearly 27% below the same 2022 week and more than 8% below the five-year average for the week. Dry van loads rose more than 7% after falling about 13% in the previous week. Volume was more than 44% below the same week last year and more than 18% below the five-year average for the week. Volume growth was strongest in the Southeast and Northeast region while no region saw a decline of more than 2% week over week.

Dry van spot rates fell 6.5 cents. Rates were nearly 27% below the same 2022 week and more than 8% below the five-year average for the week. Dry van loads rose more than 7% after falling about 13% in the previous week. Volume was more than 44% below the same week last year and more than 18% below the five-year average for the week. Volume growth was strongest in the Southeast and Northeast region while no region saw a decline of more than 2% week over week.

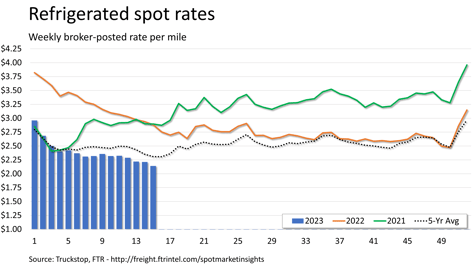

Refrigerated spot rates fell more than 7 cents. Rates were almost 26% below the same 2022 week and more than 7% below the five-year average for the week. Refrigerated loads fell by more than 8% after easing marginally in the prior week. Volume was almost 58% below the same week last year and more than 28% below the five-year average for the week. Load activity was down in all regions except the Southeast and Mountain Central regions.

Refrigerated spot rates fell more than 7 cents. Rates were almost 26% below the same 2022 week and more than 7% below the five-year average for the week. Refrigerated loads fell by more than 8% after easing marginally in the prior week. Volume was almost 58% below the same week last year and more than 28% below the five-year average for the week. Load activity was down in all regions except the Southeast and Mountain Central regions.

Flatbed spot rates barely moved, ticking up just two-tenths of a cent. Rates were nearly 23% below the same 2022 week but about 5% above the five-year average for the week. Flatbed loads edged about 1% higher after falling more than 10% in the previous week. Volume was nearly 54% below the same week last year and more than 36% below the five-year average for the week. Loads activity was mixed with a sharp increase in the Northeast and small gains in the South Central and Midwest regions but declines elsewhere.