Van segment rates and volume decline in the latest week

Spot rates and load activity for dry van and refrigerated in the Truckstop system were down during the week ended March 24 (week 12). The flatbed segment fared only slightly better as rates were basically flat week over week and volume declined, although not as much as in the van segments. The spot market tends to be sluggish between late March and mid-May, so weakness in the latest week does not necessarily suggest significant softening of spot metrics beyond seasonal expectations.

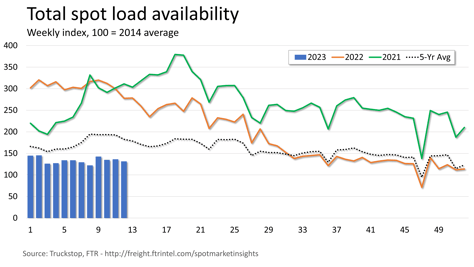

Total load activity declined 3.5% following a 1% gain in the previous week. Volume was nearly 53% below the same week last year and about 28% below the five-year average. Loads were up in the South Central and West Coast regions but down elsewhere. Truck postings increased by about 1% after declining by the same scope in the prior week. The Market Demand Index – the ratio of loads to trucks – fell to its lowest level in four weeks.

Total load activity declined 3.5% following a 1% gain in the previous week. Volume was nearly 53% below the same week last year and about 28% below the five-year average. Loads were up in the South Central and West Coast regions but down elsewhere. Truck postings increased by about 1% after declining by the same scope in the prior week. The Market Demand Index – the ratio of loads to trucks – fell to its lowest level in four weeks.

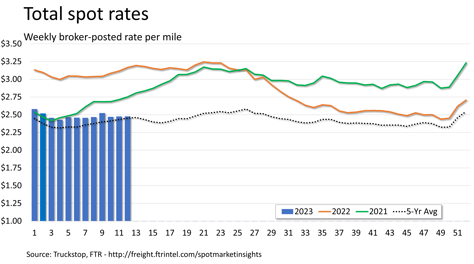

Despite decreases in dry van and refrigerated rates, the total broker-posted spot market rate was basically flat due to a marginal increase in flatbed rates, which are notably higher than those in the van segments, and that segment’s relatively stronger performance in volume week over week. Total rates were nearly 22% below the same 2022 week but about 1% above the five-year average.

Despite decreases in dry van and refrigerated rates, the total broker-posted spot market rate was basically flat due to a marginal increase in flatbed rates, which are notably higher than those in the van segments, and that segment’s relatively stronger performance in volume week over week. Total rates were nearly 22% below the same 2022 week but about 1% above the five-year average.

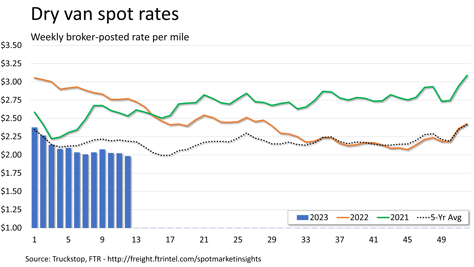

Dry van spot rates fell about 4 cents after easing about a half-cent in the prior week. Rates were more than 28% below the same 2022 week and more than 9% below the five-year average for the week. Dry van loads declined more than 5% after ticking up 0.5% in the previous prior week. Volume was nearly 51% below the same week last year and almost 30% below the five-year average for the week. Loads were up in the Mountain Central region but down elsewhere.

Dry van spot rates fell about 4 cents after easing about a half-cent in the prior week. Rates were more than 28% below the same 2022 week and more than 9% below the five-year average for the week. Dry van loads declined more than 5% after ticking up 0.5% in the previous prior week. Volume was nearly 51% below the same week last year and almost 30% below the five-year average for the week. Loads were up in the Mountain Central region but down elsewhere.

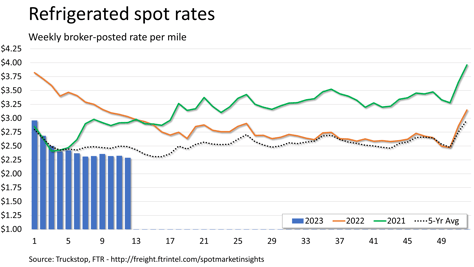

Refrigerated spot rates declined 3.6 cents after edging up about a half-cent in the previous week. Rates were about 24% below the same 2022 week and about 8% below the five-year average for the week. Refrigerated loads fell about 11% after increasing nearly 3% in the prior week. Volume was almost 56% below the same week last year and about 34% below the five-year average for the week. Load activity was up slightly on the West Coast but down in all other regions.

Refrigerated spot rates declined 3.6 cents after edging up about a half-cent in the previous week. Rates were about 24% below the same 2022 week and about 8% below the five-year average for the week. Refrigerated loads fell about 11% after increasing nearly 3% in the prior week. Volume was almost 56% below the same week last year and about 34% below the five-year average for the week. Load activity was up slightly on the West Coast but down in all other regions.

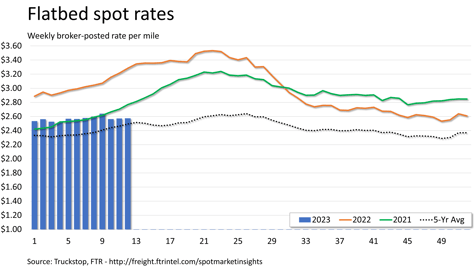

Flatbed spot rates barely moved, ticking up just a fraction of a cent after rising 1 cent in the previous week. Rates were nearly 22% below the same 2022 week but about 3% above the five-year average for the week. Flatbed loads declined about 2% after moving up about 1% in the prior week. Volume was more than 56% below the same week last year and more than 30% below the five-year average for the week. Load activity was up in the South Central and West Coast regions but down elsewhere.