Spot rates post their strongest gain of the year

After a lackluster couple of months, spot rates in the Truckstop system saw their strongest week-over-week increase of 2023 so far during the week ended March 3 (week 9). Although a late-season winter storm might have played a role, all regions saw substantial gains. The rate increases in dry van and refrigerated were not especially robust in absolute terms, but each saw its largest increase and first back-to-back increase of the year. Total volume rose by the most since the first week of 2023.

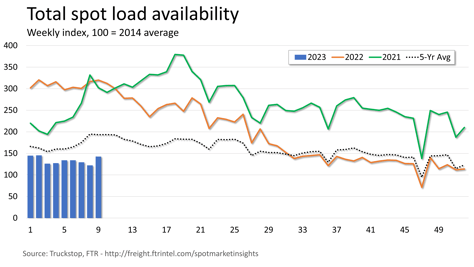

Spot load activity jumped nearly 17% due mostly to flatbed, although gains in refrigerated and dry van were solid. Volume was more than 55% below the same week last year and about 26% below the five-year average, which had been the gap two weeks earlier. Loads were up in all regions, led by the West Coast and South Central regions. Truck postings were down nearly 3%, and the Market Demand Index – the ratio of loads to trucks – rose to its highest level since the second week of this year.

Spot load activity jumped nearly 17% due mostly to flatbed, although gains in refrigerated and dry van were solid. Volume was more than 55% below the same week last year and about 26% below the five-year average, which had been the gap two weeks earlier. Loads were up in all regions, led by the West Coast and South Central regions. Truck postings were down nearly 3%, and the Market Demand Index – the ratio of loads to trucks – rose to its highest level since the second week of this year.

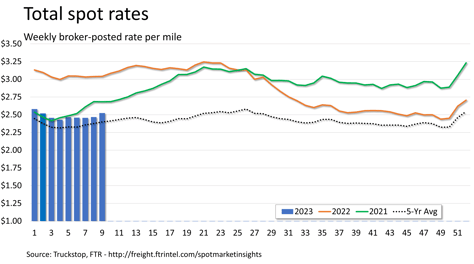

Although no individual segment saw a gain of that scope, the total broker-posted spot market rate rose nearly 6 cents. The total market rate outpaced individual segments due to the surge in flatbed volume as that segment’s rates are well ahead of those in van segments. Total rates were 17% below the same 2022 week but about 5% above the five-year average. FTR estimates that rates excluding a calculated fuel surcharge were nearly 22% below the same 2022 week.

Although no individual segment saw a gain of that scope, the total broker-posted spot market rate rose nearly 6 cents. The total market rate outpaced individual segments due to the surge in flatbed volume as that segment’s rates are well ahead of those in van segments. Total rates were 17% below the same 2022 week but about 5% above the five-year average. FTR estimates that rates excluding a calculated fuel surcharge were nearly 22% below the same 2022 week.

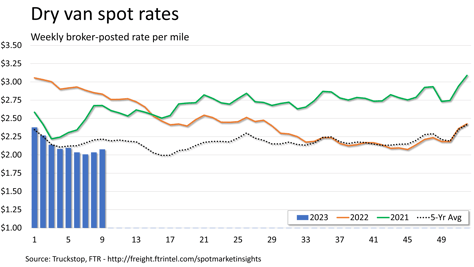

Dry van spot rates increased just over 4 cents following a gain of nearly 3 cents in the prior week. Rates were almost 27% below the same 2022 week and more than 6% below the five-year average for the week. Excluding a fuel surcharge, rates were 34% lower than in the same week last year. Dry van loads decreased nearly 6%. Volume was almost 56% below the same week last year and more than 31% below the five-year average for the week. Loads were down modestly in the Southeast but up in all other regions, and the West Coast saw the largest gain by far.

Dry van spot rates increased just over 4 cents following a gain of nearly 3 cents in the prior week. Rates were almost 27% below the same 2022 week and more than 6% below the five-year average for the week. Excluding a fuel surcharge, rates were 34% lower than in the same week last year. Dry van loads decreased nearly 6%. Volume was almost 56% below the same week last year and more than 31% below the five-year average for the week. Loads were down modestly in the Southeast but up in all other regions, and the West Coast saw the largest gain by far.

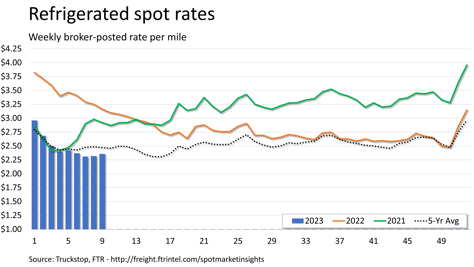

Refrigerated spot rates were up nearly 4 cents after ticking up nearly a penny in the prior week. Rates were more than 25% below the same 2022 week and nearly 5% below the five-year average for the week. Excluding fuel surcharges, rates were nearly 36% below the same week last year. Refrigerated loads rose more than 9% for the largest gain in five weeks. Volume was nearly 57% below the same week last year and nearly 32% below the five-year average for the week. Load activity was as down marginally in the Midwest but up in all other regions, although the gain in the Northeast was slight.

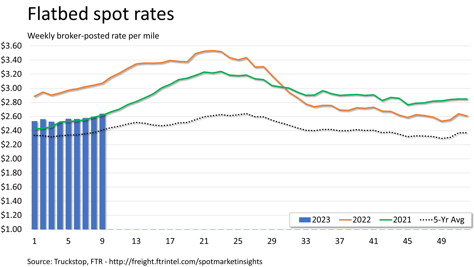

Flatbed spot rates increased just over 4 cents after rising 2 cents in the prior week. Rates were about 14% below the same 2022 week but nearly 10% above the five-year average for the week. Excluding an imputed surcharge, flatbed rates were about 18% below the same week last year. Flatbed loads surged more than 27% for the largest increase since the first week of the year, which always sees a big jump due to the end of the holiday season. Volume was nearly 59% below the same week last year and nearly 27% below the five-year average for the week. Load activity was up sharply in all regions.