Van segment spot rates continue to ease

Broker-posted dry van and refrigerated spot rates declined during the week ended February 17 (week 7), marking the sixth decrease in the past seven weeks for both segments. Over the past two weeks, dry van and refrigerated have posted notably weaker spot rates than their five-year averages. Dry van spot rates lagged the average for several weeks in November, but otherwise neither segment had seen rates significantly below average since early in the recovery from lockdowns in the spring of 2020.

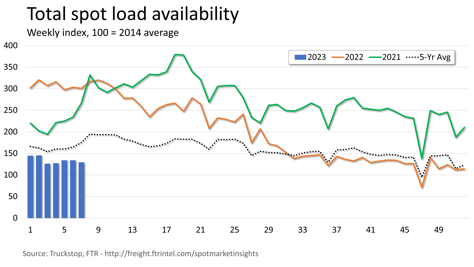

Spot load activity declined 3.5% after holding flat during the prior week. Volume was 57% below the same week last year and about 26% below the five-year average. Unusually strong volume in 2021’s week 7 skews the five-year average somewhat, although the true spike occurred during week 8 of that year. Total load activity was down in all regions except the Midwest. Truck postings increased 2%, and the Market Demand Index – the ratio of loads to trucks – fell to its lowest level in four weeks.

Spot load activity declined 3.5% after holding flat during the prior week. Volume was 57% below the same week last year and about 26% below the five-year average. Unusually strong volume in 2021’s week 7 skews the five-year average somewhat, although the true spike occurred during week 8 of that year. Total load activity was down in all regions except the Midwest. Truck postings increased 2%, and the Market Demand Index – the ratio of loads to trucks – fell to its lowest level in four weeks.

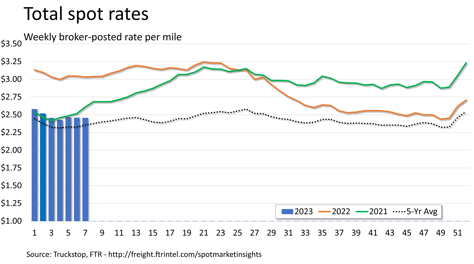

For the second straight week, the total broker-posted spot market rate barely budged, easing just three-tenths of a cent. Total rates continued to track at 19% below the same 2022 week, but they were more than 4% above the five-year average. FTR estimates that rates excluding a calculated fuel surcharge were nearly 26% below the same 2022 week.

For the second straight week, the total broker-posted spot market rate barely budged, easing just three-tenths of a cent. Total rates continued to track at 19% below the same 2022 week, but they were more than 4% above the five-year average. FTR estimates that rates excluding a calculated fuel surcharge were nearly 26% below the same 2022 week.

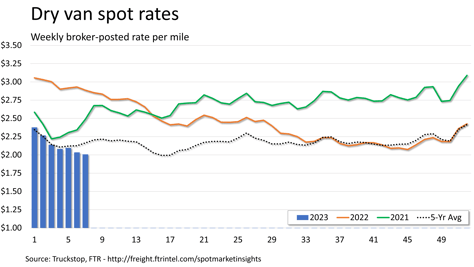

Dry van spot rates declined nearly 3 cents. Rates were more than 30% below the same 2022 week and more than 7% below the five-year average for the week, which is the weakest comparison since June 2020. Excluding a fuel surcharge, rates were almost 40% lower than in the same week last year. Dry van loads declined 4.5%. Volume was more than 59% below the same week last year and almost 30% below the five-year average for the week. Load activity was down in the Northeast, Midwest, and West Coast regions and up only slightly elsewhere.

Dry van spot rates declined nearly 3 cents. Rates were more than 30% below the same 2022 week and more than 7% below the five-year average for the week, which is the weakest comparison since June 2020. Excluding a fuel surcharge, rates were almost 40% lower than in the same week last year. Dry van loads declined 4.5%. Volume was more than 59% below the same week last year and almost 30% below the five-year average for the week. Load activity was down in the Northeast, Midwest, and West Coast regions and up only slightly elsewhere.

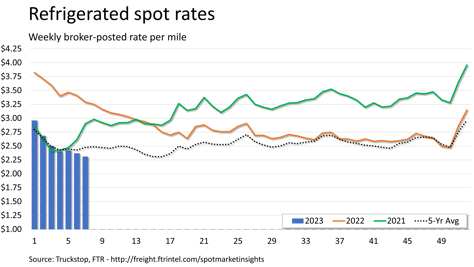

Refrigerated spot rates fell nearly 6 cents. Rates were almost 30% below the same 2022 week and nearly 7% below the five-year average for the week. As with dry van, the comparison versus the five-year average is the weakest since June 2020. Excluding fuel surcharges, rates were nearly 38% below the same week last year. Refrigerated loads fell nearly 12%. Volume was more than 61% below the same week last year and more than 36% below the five-year average for the week. Load activity was down in all regions.

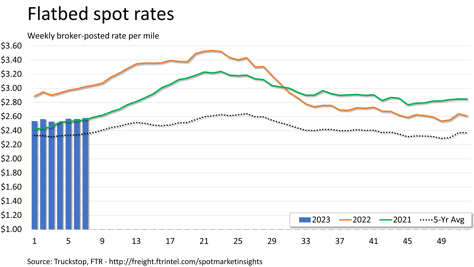

Flatbed spot rates ticked up more than a cent. Rates were almost 15% below the same 2022 week but more than 9% above the five-year average for the week. Excluding an imputed surcharge, flatbed rates were more than 20% below the same week last year. Flatbed loads declined about 2% for the first week-over-week decrease this year. Volume was nearly 60% below the same week last year and more than 28% below the five-year average for the week. Load activity was up in the Midwest and West Coast regions but down elsewhere.