Van segments’ spot rates resume their 2023 slide

A week after posting small gains, dry van and refrigerated spot rates in the Truckstop system returned to their cooling trend during the week ended February 10 (week 6). Overall broker-posted rates eased only slightly as flatbed spot rates barely changed week over week. The van segments weakened slightly relative to the five-year average while flatbed rates were basically steady at above-average levels. Total load activity was flat as a gain in flatbed offset declines in dry van and refrigerated.

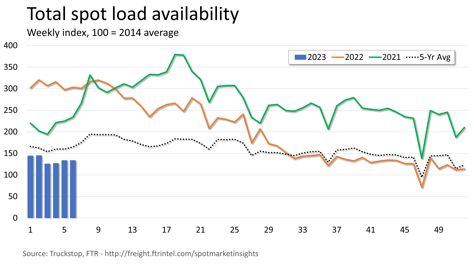

Spot volume was essentially unchanged from the prior week. Volume was about 56% below the same week last year and nearly 19% below the five-year average. Total load activity was up in the South Central, Southeast, and West Coast regions, although the West Coast gain was marginal. Like volume, truck postings barely changed, and the Market Demand Index – the ratio of loads to trucks – basically matched that in the prior week.

Spot volume was essentially unchanged from the prior week. Volume was about 56% below the same week last year and nearly 19% below the five-year average. Total load activity was up in the South Central, Southeast, and West Coast regions, although the West Coast gain was marginal. Like volume, truck postings barely changed, and the Market Demand Index – the ratio of loads to trucks – basically matched that in the prior week.

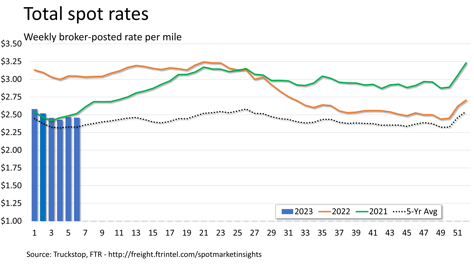

The total broker-posted spot market rate eased half a cent. Total rates continued to track basically at 19% below the same 2022 week, and they were about 6% above the five-year average. FTR estimates that rates excluding a calculated fuel surcharge were about 27% below the same 2022 week.

The total broker-posted spot market rate eased half a cent. Total rates continued to track basically at 19% below the same 2022 week, and they were about 6% above the five-year average. FTR estimates that rates excluding a calculated fuel surcharge were about 27% below the same 2022 week.

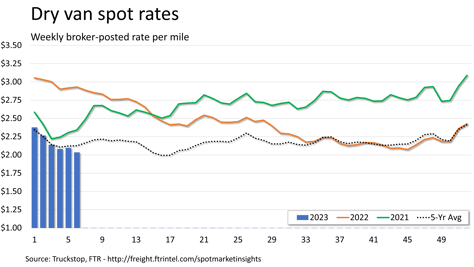

Dry van spot rates fell 6 cents after ticking up more than a cent in the prior week. Rates were nearly 31% below the same 2022 week and more than 4% below the five-year average for the week. Excluding a fuel surcharge, rates were almost 41% lower than in the same week last year. Dry van loads declined more than 5% after rising more than 6% in the prior week. Volume was more than 59% below the same week last year and almost 19% below the five-year average for the week. Load activity increased in the Southeast but was down in all other regions.

Dry van spot rates fell 6 cents after ticking up more than a cent in the prior week. Rates were nearly 31% below the same 2022 week and more than 4% below the five-year average for the week. Excluding a fuel surcharge, rates were almost 41% lower than in the same week last year. Dry van loads declined more than 5% after rising more than 6% in the prior week. Volume was more than 59% below the same week last year and almost 19% below the five-year average for the week. Load activity increased in the Southeast but was down in all other regions.

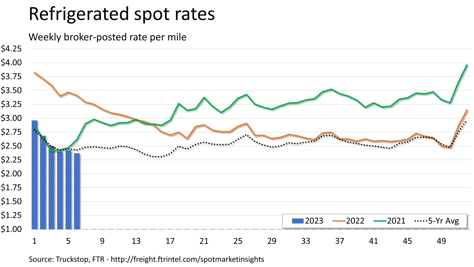

Refrigerated spot rates declined about 5 cents after rising about 2 cents in the prior week. As with dry van, refrigerated rates were about 31% below the same 2022 week. Rates were more than 2% below the five-year average for the week, which is the weakest comparison since June 2020. Excluding fuel surcharges, rates were 39% below the same week last year. Refrigerated loads fell nearly 10% after jumping nearly 21% in the previous week. Volume was more than 63% below the same week last year and 24% below the five-year average for the week. Load activity was up slightly in the Southeast but was down in all other regions.

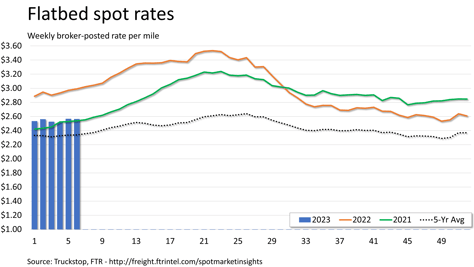

Flatbed spot rates eased by a fraction of a cent after rising more than 5 cents in the previous week. Rates were more than 14% below the same 2022 week but nearly 10% above the five-year average for the week. Excluding an imputed surcharge, flatbed rates were 21% below the same week last year. Flatbed loads rose nearly 7% after ticking up 0.4% in the prior week. Volume, which has increased in every week of 2023 so far, was almost 56% below the same week last year and nearly 24% below the five-year average for the week. Load activity was down in the Mountain Central and Midwest regions but up elsewhere.