Spot rates experience typical post-holiday decline

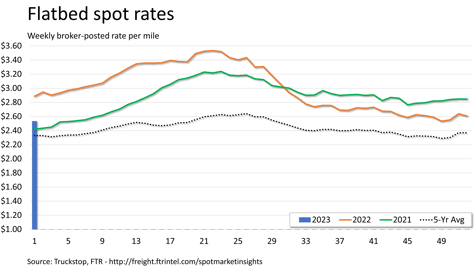

Spot rates and volumes in the Truckstop system performed according to expectations during the week ended January 6 (week 1) as load activity rose sharply and rates dropped sharply following the December holidays. Spot rates fell in all segments. Refrigerated and dry van rates remain well above pre-holiday levels, but flatbed spot rate declines in the past two weeks offset gains in the two prior weeks. Flatbed and dry van saw sharp increases in volume, but refrigerated loads were down slightly.

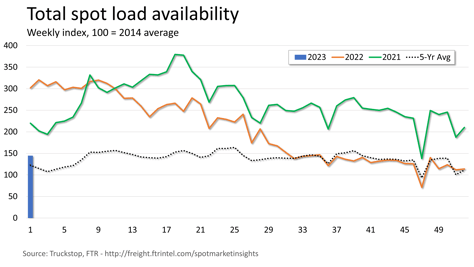

Total spot volume jumped 27.3%. Volume was 52% below the same 2022 week and nearly 13% below the five-year average for the week. Load activity was up sharply in all regions, led by the Midwest. Truck availability rose by 16.6% after the large drop during the holidays, and the Market Demand Index – the ratio of loads to trucks – rose to its highest level since June.

Total spot volume jumped 27.3%. Volume was 52% below the same 2022 week and nearly 13% below the five-year average for the week. Load activity was up sharply in all regions, led by the Midwest. Truck availability rose by 16.6% after the large drop during the holidays, and the Market Demand Index – the ratio of loads to trucks – rose to its highest level since June.

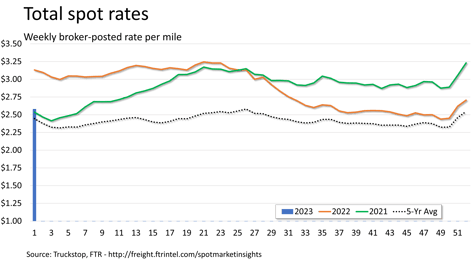

The total broker-posted spot market rate fell nearly 13 cents. Rates were almost 18% below the same 2022 week but nearly 6% above the five-year average for the week. FTR estimates that rates excluding a calculated fuel surcharge were more than 26% below the 2022 week.

The total broker-posted spot market rate fell nearly 13 cents. Rates were almost 18% below the same 2022 week but nearly 6% above the five-year average for the week. FTR estimates that rates excluding a calculated fuel surcharge were more than 26% below the 2022 week.

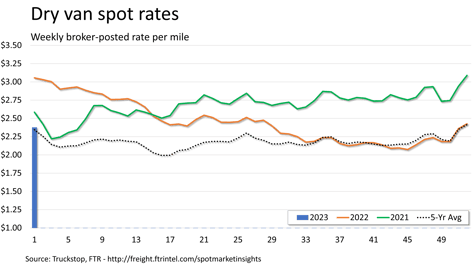

Dry van spot rates declined nearly 5 cents after rising more than 24 cents in the final two weeks of 2022. Rates were about 22% below the same 2022 week and more than 1% above the five-year average for the week. Dry van rates excluding a fuel surcharge were 32% lower than in the same 2022 week. Dry van loads rose 30%. Volume was about 50% below the same 2022 week and about 3% below the five-year average for the week.

Dry van spot rates declined nearly 5 cents after rising more than 24 cents in the final two weeks of 2022. Rates were about 22% below the same 2022 week and more than 1% above the five-year average for the week. Dry van rates excluding a fuel surcharge were 32% lower than in the same 2022 week. Dry van loads rose 30%. Volume was about 50% below the same 2022 week and about 3% below the five-year average for the week.

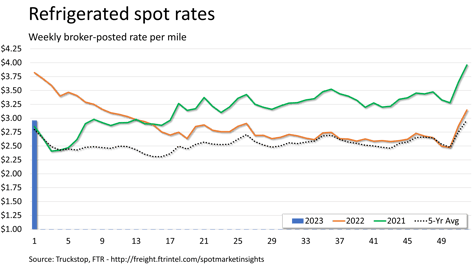

Refrigerated spot rates fell nearly 19 cents after surging more than 67 cents in the final two weeks of 2022. Rates were nearly 23% below the same 2022 week but 6% above the five-year average for the week. Rates excluding fuel surcharges were about 30% below the same 2022 week. Refrigerated loads surged and declined 4% after rising for three straight weeks. Volume was 53% below the same 2022 week and about 4% below the five-year average for the week.

Flatbed spot rates declined more than 7 cents. Rates were about 12% below the same 2022 week but nearly 9% above the five-year average for the week. Excluding an imputed surcharge, flatbed rates were about 21% below the same week last year. Flatbed loads surged nearly 56% to the highest level since early November. Volume was more than 58% below the same 2022 week and nearly 32% below the five-year average for the week.