Spot rates see typical holiday surge heading into holidays

Broker-posted spot rates in the Truckstop system jumped sharply during the week ended December 23 (week 51) as truck capacity plunged by the most since the week that included the Independence Day holiday. The overall rate increase essentially matched the one experienced during the same 2021 week. The refrigerated segment’s surge in rates was the largest since the final week of 2017. Dry van rates saw their largest gain since the same week last year, and flatbed rates rose by the most since May.

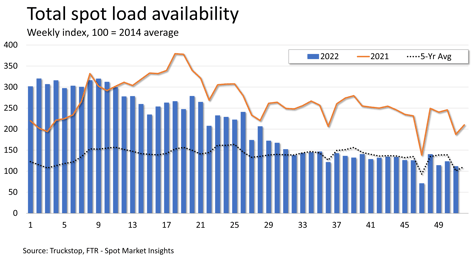

Total spot volume fell 9.4%. Volume was about 40% below the same 2021 week but 11% above the five-year average for the week. Load activity was down in all regions, but refrigerated segment gains in the Southwest, South Central, and Midwest regions kept total volume losses in those regions relatively small. Truck availability fell by 18.2%, and the Market Demand Index – the ratio of loads to trucks – rose to its highest level since July.

Total spot volume fell 9.4%. Volume was about 40% below the same 2021 week but 11% above the five-year average for the week. Load activity was down in all regions, but refrigerated segment gains in the Southwest, South Central, and Midwest regions kept total volume losses in those regions relatively small. Truck availability fell by 18.2%, and the Market Demand Index – the ratio of loads to trucks – rose to its highest level since July.

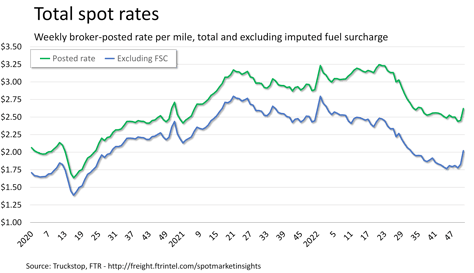

The total broker-posted spot market rate soared just under 17 cents. Rates were about 14% below the same 2021 week but about 9% above the five-year average for the week. However, FTR estimates that rates excluding a calculated fuel surcharge were nearly 23% below the same week last year.

The total broker-posted spot market rate soared just under 17 cents. Rates were about 14% below the same 2021 week but about 9% above the five-year average for the week. However, FTR estimates that rates excluding a calculated fuel surcharge were nearly 23% below the same week last year.

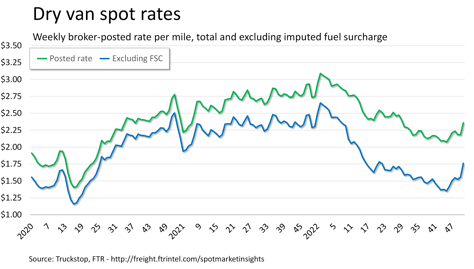

Dry van spot rates rose nearly 18 cents. Rates were almost 20% below the same 2021 week and more than 1% above the five-year average for the week. Dry van rates excluding a fuel surcharge were nearly 30% lower than in the same week last year. Dry van loads decreased 13.2%. Volume was nearly 37% below the same 2021 week but almost 16% above the five-year average for the week.

Dry van spot rates rose nearly 18 cents. Rates were almost 20% below the same 2021 week and more than 1% above the five-year average for the week. Dry van rates excluding a fuel surcharge were nearly 30% lower than in the same week last year. Dry van loads decreased 13.2%. Volume was nearly 37% below the same 2021 week but almost 16% above the five-year average for the week.

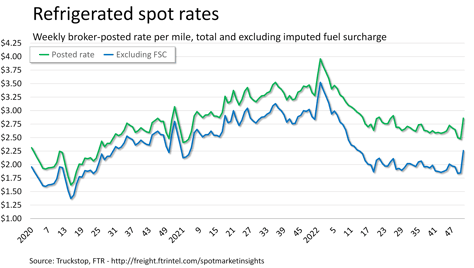

Refrigerated spot rates surged nearly 39 cents. Rates were almost 22% below the same 2021 week but more than 5% above the five-year average for the week. Rates excluding fuel surcharges were nearly 30% below the same week last year. Refrigerated loads jumped about 22%. Volume was about 43% below the same week last year but about 17% above the five-year average for the week.

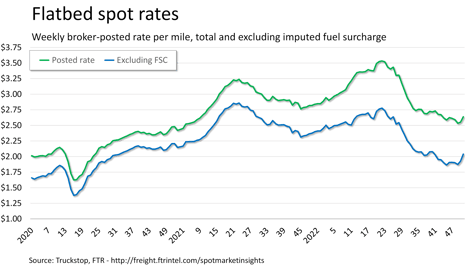

Flatbed spot rates increased nearly 9 cents. Rates were about 7% below the same 2021 week but nearly 16% above the five-year average for the week. Excluding an imputed surcharge, flatbed rates were more than 15% below the same week last year. Flatbed loads fell 17%. Volume was more than 51% below the same 2021 week and more than 9% below the five-year average for the week.